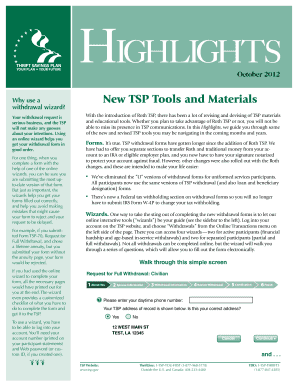

43 thrift savings plan loan payment coupon

Can You Borrow Money From Tsp For Education? - june29.com Can I Borrow From My Thrift Savings Plan? You can earn up to $50,000 through a one-time loan of up to $1,000 if you saved enough in your 401 (k). As long as you use the loan for the purposes, the funds can be repaid on a fixed annual rate over 5 years or 15 years. Payments may be made into your bank account via automatic transfer. 6 Errors Federal Staff Generate Along with their Thrift ... step one. Envision maybe not causing Teaspoon Since the a national worker, 5% of your bi-per week income is decided as lead to the Thrift Coupons bundle. Because of the giving 5% of your own salary on the Tsp, their department adds all in all, 5% to your package, thereby doubling their monthly donations.

9 Best Retirement Plans In April 2022 - Bankrate The Federal Thrift Savings Plan The Thrift Savings Plan (TSP) is a lot like a 401(k) plan on steroids, and it's available to government workers and members of the uniformed services.

Thrift savings plan loan payment coupon

Manual Pay Processing - National Finance Center Filter: All DOTSE NONAUTO SPPS SPPS WEB. Start Date - End Date. Bulletin. Date. MANPAY 22-02, Start of Dual Lump Sum Payments. 04-11-22. MANPAY 22-01, Change to the Security Warning Banner Message. 02-25-22. Payment Coupon Book Printable - dealspothub.com (Updated 16 minutes) Payment Coupon Templates - 11+ Free Printable PDF Documents Download A payment coupon template was designed to help you help customers make payments at the counter in a personalized way. The coupon template is only used at an instance where you want your customers to purchase available items at discount prices. ... No need code Pay and Benefits for Federal Employees | USAGov The Thrift Savings Plan (TSP) is a retirement plan for federal government employees and members of the military. Find the basics about participating - Eligibility, contributions, loans, withdrawals, setting up and managing your account. Learn about investment funds - Overview of fund types, fund options, and performance.

Thrift savings plan loan payment coupon. Updates for Taxpayers | Department of Taxation The Hawaii State Department of Taxation has not extended the 2021 Tax Year filing deadline. Taxpayers must file their returns by April 20, 2022. While the law requires taxpayers to file by April 20, taxpayers are granted an automatic 6-month extension (no form is required to request the extension) to file the return through October 20, 2022 if ... B3-3.1-09, Other Sources of Income (12/15/2021) For example, if a borrower obtains a $100,000 mortgage that has a note rate of 7.5% and he or she is eligible for a 20% credit under the MCC program, the amount that should be added to his or her monthly income would be $125 ($100,000 x 7.5% x 20% = $1500 ÷ 12 = $125). 6 Errors Federal Employees Generate Employing Thrift ... An excellent Thrift Coupons Plan (TSP) is a type of old-age plan that merely federal group and you can the police people players, including the Ready Put aside, may use. It is a defined-share bundle providing you with federal workers literally comparable masters like typical old-age plans for people in the private sector. The Ideal Withdrawal Rate For Retirement Does Not Touch ... The ideal withdrawal rate for retirement does not touch principal. Ideally, you want to live off your retirement principal income for the rest of your life. This way, you won't have to stress about running out of money. Further, if you never touch principal, you can leave a legacy for your children and charities following the Legacy Retirement Philosophy.

6 Problems Government Employees Create Through its Thrift ... step 1. Think not adding to Teaspoon Due to the fact a federal worker, 5% of your bi-per week salary is decided to be resulted in the Thrift Coupons plan. Because of the giving 5% of your paycheck towards Teaspoon, your company adds a total of 5% for the package, and thus increasing their monthly contributions. six Problems Federal Professionals Build With regards to ... A good Thrift Coupons Plan (TSP) is a type of old age plan one to only government employees and you will the police area members, such as the Ready Set aside, are able to use. It's a defined-sum plan that gives government workers literally equivalent experts eg regular later years arrangements for all those employed in the private business. The Best Online Financial Advisors in April 2022 Additional SoFi membership perks include loan discounts and career counseling ... trust, and 529 college savings plan. What stands out: Only top online advisor to offer 529 plans ... 457, Thrift ... New York Community Bancorp, Inc. (NYCB) CEO Thomas Cangemi ... Now moving on to loan growth, after $2 billion of loan growth during the fourth quarter of last year, total loans grew by $1 billion during the first quarter to $46.8 billion, up 9% annualized on ...

New York State Tax Updates - Withum Returns and estimated income tax voucher payments are due when required by law, with a liberal abatement of penalties, and an accrual of statutory interest. While the Department did not provide for a blanket extension to a specified date (i.e., NYS extended to July 15th), the Department does plan on approving extension requests. Save money and get tax-free earnings for medical expenses and health care premiums during retirement. Employee Stock Purchase Plan. Take stock in PSEG through the discount Employee Stock Purchase Plan after one year of service. It provides the way for you to purchase shares of enterprise common stock at a 5-10% discount from the market value. Daily Treasury Statement Change the name Thrift Savings Plan Transfer to Federal Retirement Thrift Savings Plan in Table 2 (deposits withdrawal side). This line will show daily. Stay up to Date with the Daily Treasury Statement. Subscribe to e-mail notifications! Join the Mailing List six Mistakes Federal Teams Build Employing Thrift Savings Plan six Mistakes Federal Teams Build Employing Thrift Savings Plan Good Thrift Offers Plan (TSP) is a type of advancing years package one just federal staff …

FedSmith.com | News For Federal Employees & Retirees FedSmith.com is a free news service for federal employees and retirees on topics such as pay, benefits, retirement and the Thrift Savings Plan (TSP).

Finance (Under Development) - The Business Professor, LLC Economic Analysis & Monetary Policy Research, Quantitative Analysis, & Decision Science Investments, Trading, and Financial Markets Banking, Lending, and Credit Industry Business Finance, Personal Finance, and Valuation Principles. Courses. + More.

Defined Contribution (DC) Plan Definition A defined-contribution (DC) plan is a retirement plan that's typically tax-deferred, like a 401 (k) or a 403 (b), in which employees contribute a fixed amount or a percentage of their paychecks to ...

4 Ways You Can Crush Your Retirement Goals While You're in ... For 2022, you can contribute up to $20,500 to employer plans like a 401(k), 403(b), or Thrift Savings Plan (TSP) if you're under 50. The contribution limit goes up to $27,000 if you are 50 and over.

How to Use MyPay | The Military Wallet You can change your Thrift Savings Plan (TSP) contributions in the "Pay Changes" section of myPay. Other changes will have to be done through TSP's website or by filling out form Thrift Savings Plan Election Form TSP-U-1 and turning it into your finance office. You can start, change, or stop TSP contributions with myPay.

Advance Child Tax Credit Eligibility 2021 | The Military ... For the 2021 tax year, the Child Tax Credit increased from $2,000 per qualifying child to: $3,600 for children ages 5 and younger at the end of 2021 $3,000 for children ages 6 through 17 at the end of 2021 Monthly Advance Child Tax Credit (CTC) payments of $250 and $300 started in July and ended in December.

Amex Platinum Military 2022 | $695 Fee Waived for Active Duty The Platinum Card® from American Express military policy waives the $695 per year annual fee on the Amex Platinum card for active duty servicemembers and military spouses.. The American Express Platinum military fee waiver removes the annual fees to comply with the Military Lending Act (MLA) and Servicemembers Civil Relief Act (SCRA).. If you are in the military on active duty orders, you are ...

Your Marathon Benefits | Capstone Wealth Advisors ... As an employee, you can contribute $19,500 (or $26,000 for those over 50 years old) of pre-tax or Roth savings to the Marathon Oil Thrift Plan. Additionally, your Thrift plan allows you to make "After-Tax" contributions in excess of the regular funding limits which allows you to save even more than most plans for retirement.

Financial Specialist Vacancy Announcement: 2022-08-USDC sick leave, 11 paid holidays, retirement benefits, and Thrift Savings Plan (TSP) including a government match of up to 5%. Optional benefits include health and life insurance, dental and vision insurance, long-term care insurance, a Flexible

Government Assistance Programs - Investopedia President Biden injected an additional $7.25 billion into the PPP with his signature on the American Rescue Plan Act of 2021. PPP loans will be entirely forgiven as long as 60% of the loan is used ...

Pay and Benefits for Federal Employees | USAGov The Thrift Savings Plan (TSP) is a retirement plan for federal government employees and members of the military. Find the basics about participating - Eligibility, contributions, loans, withdrawals, setting up and managing your account. Learn about investment funds - Overview of fund types, fund options, and performance.

Post a Comment for "43 thrift savings plan loan payment coupon"