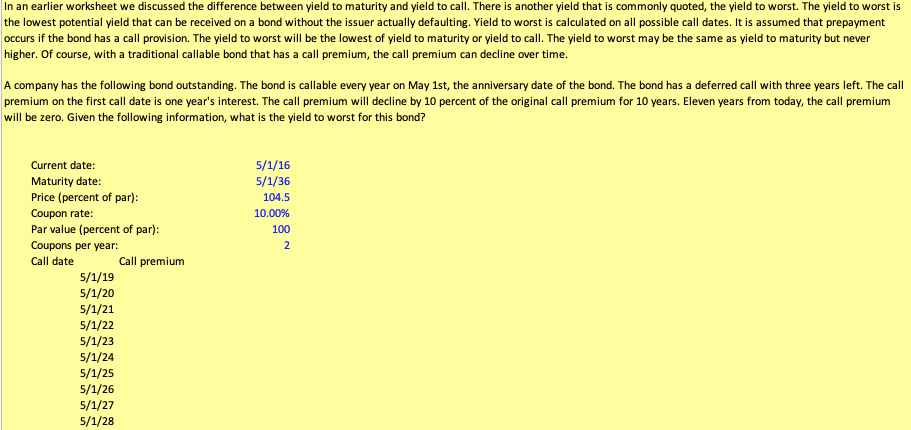

40 difference between yield to maturity and coupon rate

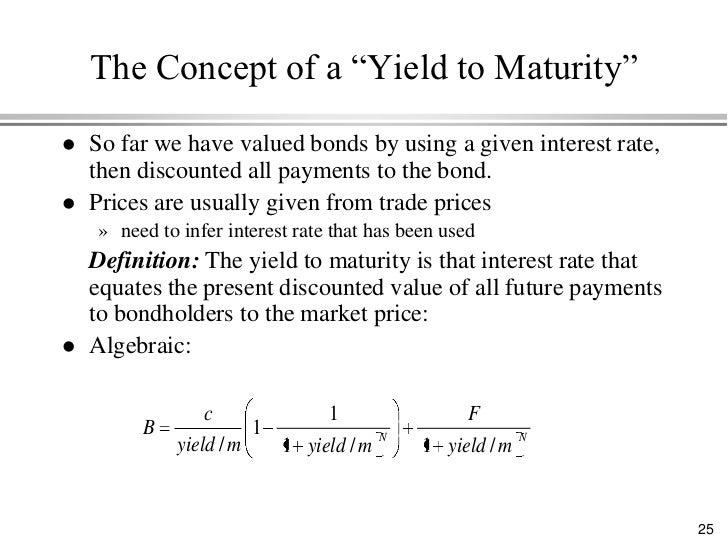

Yield To Maturity - Bond Yield - recentlyheard.com Since discount securities have a lower coupon rate than current interest rates, the yield to maturity will be higher than the nominal rate. If a bond is at 5% is sold at $950, the YTM will be greater than 5% because the investor is earning 5% on $1000, when he only invested $950 and he will get $1000 at maturity. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? Aug 22, 2021 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

ETF Areas To Consider As Fed Hikes Rates Again In 2022 This may increase the yield to maturity of bonds. Higher bond yields might raise the market's risk-free returns. A risk-free market interest rate hike can raise the cost of funds, enabling financial companies to widen the spread between longer-term assets, such as loans, with shorter-term liabilities, thus boosting the financial sector's ...

Difference between yield to maturity and coupon rate

10-Year Treasury Constant Maturity Minus Federal Funds Rate Graph and download economic data for 10-Year Treasury Constant Maturity Minus Federal Funds Rate (T10YFF) from 1962-01-02 to 2022-05-03 about yield curve, spread, 10-year, maturity, federal, Treasury, interest rate, interest, rate, and USA. Bond Yield | Definition | Finance Strategists A bond purchased at its face value of $1000 with a coupon rate of 5% returns $50 annually, so its yield is 5%. If the bondholder later sells the bond to another investor at a premium for $1100, the bond will still return $50 annually, but its yield will be lower. $50 is 4.5% of $1100, so the yield to the new investor is only 4.5%. Yield to Worst - Meaning, Importance, Calculation and More Formula to calculate Yield to Maturity = / [ (FV + PV)/2] Here C = coupon or interest amount, FV = face value of the bond, PV = present value of the bond, and T = term of the bond. So, to calculate YTW, we change the t to the period when the issuer recalls the bond. Another formula to calculate YTW is: YTW = Risk-Free Rate plus Credit Risk Premium

Difference between yield to maturity and coupon rate. Preferreds Weekly Review: A Look At Unusual Bond ... One way to think about it is that, in case of make-whole, investors are receiving a windfall of the yield differential between the bond's yield-to-maturity and its make-whole contractual discount... Yield to Maturity (YTM) Definition - investopedia.com 06.09.2021 · Calculations of yield to maturity (YTM) assume that all coupon payments are reinvested at the same rate as the bond's current yield and take into account the bond's current market price, par value ... xplaind.com › 978010Yield Spread: G-Spread, Z-Spread & OAS | Formula & Example Apr 28, 2019 · Yield spread is the difference between the yield to maturity on different debt instruments. Common examples of yield spreads are g-spread, i-spread, zero-volatility spread and option-adjusted spread. Bond yield is the internal rate of return of the bond cash flows. It is the rate of return that a bondholder earns if he holds the bond till ... India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.215% yield. 10 Years vs 2 Years bond spread is 99.7 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.40% (last modification in May 2022). The India credit rating is BBB-, according to Standard & Poor's agency.

SPIP: SPDR® Portfolio TIPS ETF - SSGA Current Yield. A bond's annual return based on its annual coupon payments and current price (as opposed to its original price or face). The formula for current yield is a bond's annual coupons divided by its current price. 10-Year Treasury Note Definition - Investopedia Treasury notes have maturities ranging from a year to 10 years, while bonds are Treasury securities with maturities longer than 10 years. 1 Treasury notes and bonds pay interest at a fixed rate... Weighted Average Maturity - (WAM) Bond C, a $15,000 bond (50%) with a maturity of four years. To compute WAM, each of the percentages is multiplied by the years until maturity, so the investor can use this formula: (16.7% X 10... Municipal Bonds Market Yields | FMSbonds.com Municipal Market Yields. The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. These rates reflect the approximate yield to maturity that an investor can earn in today's tax-free municipal bond market as of 05/02/2022.

United States Interest Rates: T-bill - Economy.com Coupon securities Securities that pay periodic interest. They are purchased at a price very close to face value and at maturity are redeemed at face value. The rate of interest paid periodically, typically every six months, is referred to as its "coupon". Equivalent bond yield (EBY) Duration vs. Maturity and Why the Difference Matters 01.09.2017 · See the diagram below to understand the relationship between the bond’s price and its interest rate (or coupon rate). A bond is quoted with its “coupon yield”. This refers to the annual interest payable as a percent of the original face or par value. An 8% bond with a par value of 1000 would receive $80 per year. Coupon/Interest Rate= 8% Treasury Return Calculator, With Coupon Reinvestment Using the 10 year yield at the 7 year mark assumes a flat yield curve. For an example of this method breaking down, see the constant maturity series for 1/02/2013 - the 10 year prevailing yield was 1.86%, but the 7 year yield was 1.25%. Bond Yield and Return | FINRA.org In the yield curve above, interest rates (and also the yield) increase as the maturity or holding period increases—yield on a 30-day T-bill is 2.55 percent, compared to 4.80 percent for a 20-year Treasury bond—but not by much. When an upward-sloping yield curve is relatively flat, it means the difference between an investor’s return from a short-term bond and the return from a long …

South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 9.995% yield.. 10 Years vs 2 Years bond spread is 448 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.25% (last modification in March 2022).. The South Africa credit rating is BB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 313.76 and implied probability of default is 5.23%.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

The securities offer contingent coupon payments at an annualized rate that, if all are paid, would produce a yield that is generally higher than the yield on our conventional debt securities of the same maturity. This higher potential yield is associated with greater levels of expected risk as of the pricing date for the securities, including ...

Yield vs. Interest Rate: What's the Difference? 17.12.2021 · Here, the interest rate is also known as the coupon rate. This rate represents the regular, periodic payment based on the borrowed principal that the investor receives in return for buying the bond.

91 Day T Bill Treasury Rate - Bankrate The yield on 91-day Treasury bills is the average discount rate. How it's used: The rate is used as an index for various variable rate loans, particularly Stafford and PLUS education loans.

ETF Areas to Consider as Fed Hikes Rates Again in 2022 The 30-year Treasury bond yield also increased to roughly 3.126%. The central bank hiked the benchmark interest rates by 50 basis points on May 4, in line with market projections. Notably, the ...

Difference Between Bonds and Loans - Which is Better? Furthermore, bonds have a fixed tenure, and on maturity, the bondholder receives their principal amount back. On the other hand, a loan is a debt instrument with a variable interest rate that banks and financial institutions usually offer. Also, the term of loans is agreed upon by the loan issuer and the person seeking the loan. Bonds vs Loans

Post a Comment for "40 difference between yield to maturity and coupon rate"