45 yield to maturity of coupon bond

Nominal yield - Wikipedia The coupon rate (nominal rate, or nominal yield) of a fixed income security is the interest rate that the issuer agrees to pay to the security holder each year, expressed as a percentage of the security's principal amount or par value. The coupon rate is typically stated in the name of the bond, such as "US Treasury Bond 6.25%". Unlike current yield, it does not vary with the market price of ... Yield to Maturity Calculator | Good Calculators r = 6.48%, The Yield to Maturity (YTM) is 6.48% You may also be interested in our free Tax-Equivalent Yield Calculator Currently 4.36/5 1 2 3 4 5 Rating: 4.4 /5 (198 votes)

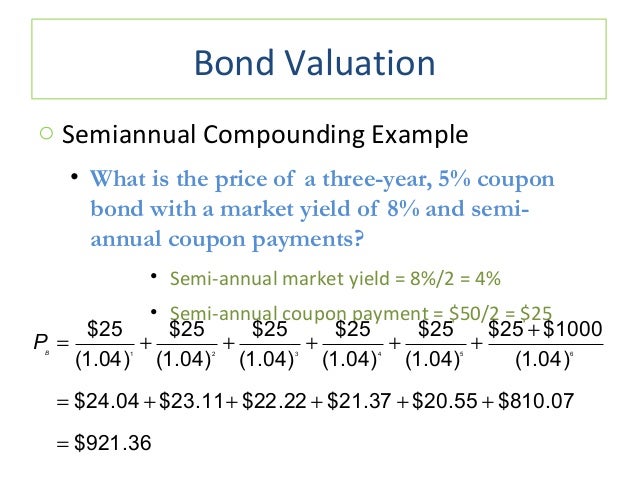

(Yield to maturity) A bond's market price is $775. It ... Transcribed image text: (Yield to maturity) A bond's market price is $775. It has a $1,000 par value, will mature in 14 years, and has a coupon interest rate of 9 percent annual interest, but makes its interest payments semiannually.

Yield to maturity of coupon bond

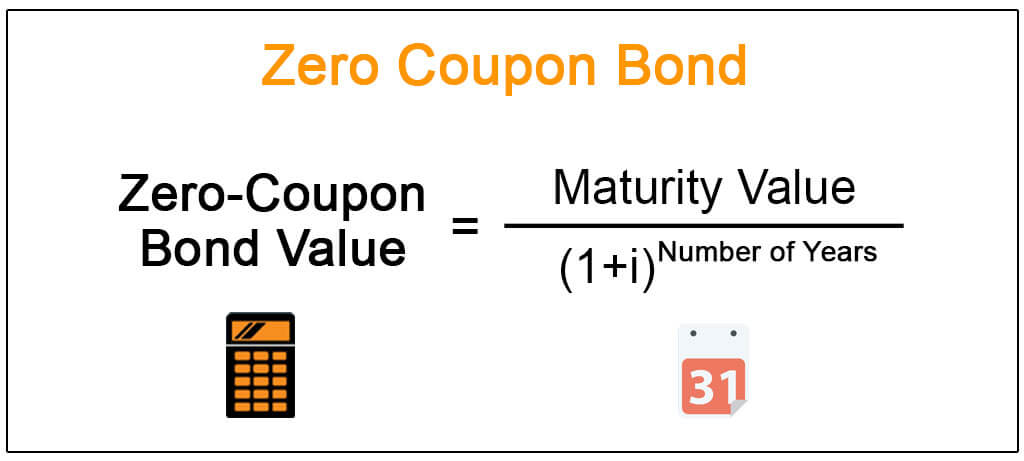

Solved "A zero-coupon bond has a yield to maturity of 5% ... "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. If the bond matures in 5 years, it should sell for a price of _____ today. "Question: "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. If the bond matures in 5 years, it should sell for a price of _____ today. How to calculate yield to maturity in Excel (Free Excel ... Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. exploringfinance.com › bond-duration-calculatorBond Duration Calculator - Exploring Finance Number of years to maturity is 2; Yield is 8% ; Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually; Bond price is 963.7; Based on the above information, here are all the components needed in order to calculate the Macaulay Duration: m = Number of payments per period = 2; YTM = Yield to Maturity = 8% or 0.08; PV ...

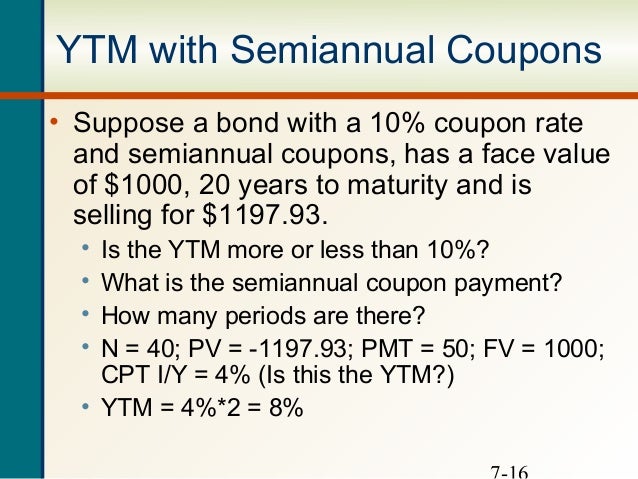

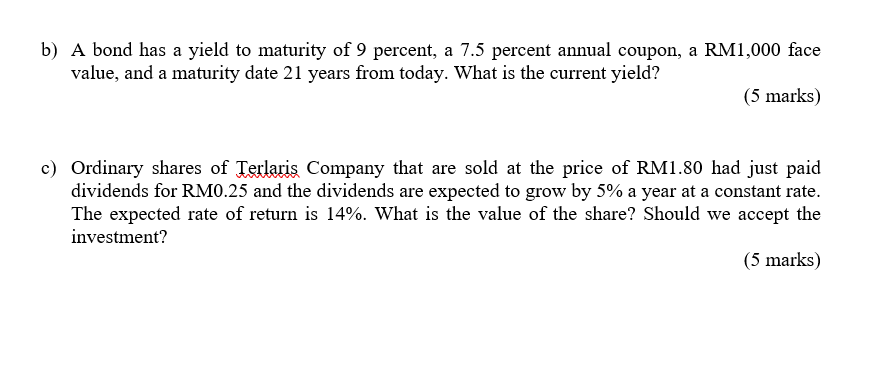

Yield to maturity of coupon bond. Yield to Maturity(YTM): Definition, Formula & Calculation In an ideal scenario with no change in bond price, the yield to maturity would also be 5%, i.e., the same as the coupon rate provided the bond is held till maturity. Now, if the market rate of interest goes up to say 6%, this bond becomes less valuable, as investors would not find this investment (at coupon 5%) opportunity attractive. Answered: How would someone calculate the yield… | bartleby Please see attached. Definitions: Yield to maturity (YTM) is the return the bond holder receives on the bond if held to maturity. Treasury note is a U.S. government bond with a maturity of between two and ten years. Current yield is the annual bond coupon payment divided by the current price. Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of yield to maturity. Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually. Yield to Maturity (Approx) = ( 37.50 + (1000 - 1101.79) / (20 * 2) )/ ( (1000 + 1101.79) / 2) YTM will be - This is an approximate yield on maturity, which shall be 3.33%, which is semiannual.

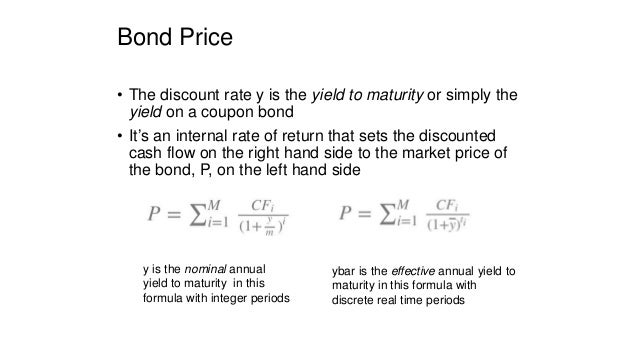

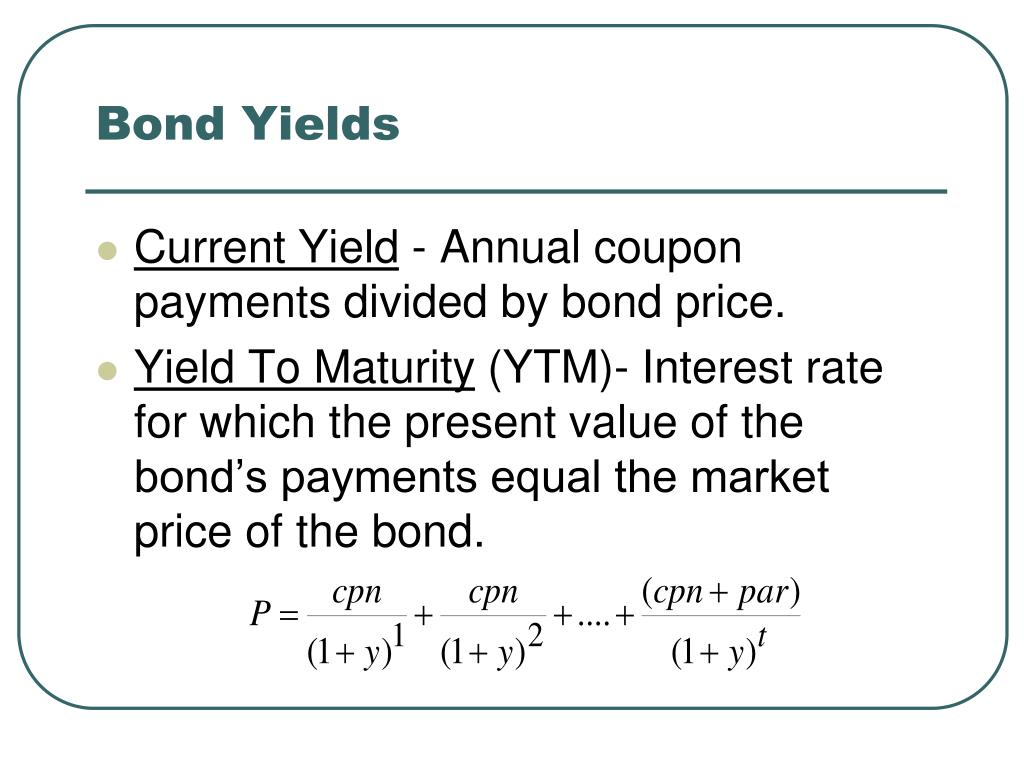

Yield to Maturity (YTM) Definition A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond... Yield to Maturity (YTM) Definition & Example ... Yield to maturity refers to the return (or yield) that an investor will earn from their investment, which is typically reported as an annual rate. The return is comprised of interest payments (referred to as coupons) and any gain in the bond's market value. The yield is based on the coupon rate the bondissuer agrees to pay. › calculator › bond_yield_calculatorBond Yield Calculator - Moneychimp Coupon Rate: % Years to Maturity: Results: Current Yield: ... See How Finance Works for the formulas for bond yield to maturity and current yield. Compound Interest Solved 5. The yield to maturity on a bond is - Chegg A. time to maturity. B. coupon rate. C. yield to maturity. D. B and C 7. Holding other factors constant, the interest-rate risk of a coupon bond is higher when the bond's: A. term-to-maturity is higher. B. coupon rate is higher. C. yield to maturity is higher. D. all of the above 8.

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures. Understanding Coupon Rate and Yield to Maturity of Bonds ... To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Yield to Maturity | Formula, Examples, Conclusion, Calculator The yield to maturity is the rate of return an investor would earn if they held a bond until it reached maturity. This calculation takes into account the face value, the current price, and any coupon payments that are made. What is the yield to maturity formula? The most common formula used to calculate yield to maturity is: YTM = C + F−P/n / F+P/2 Yield to Maturity - What it is, Use, & Formula - Speck ... Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is held to maturity. There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / Current Value) (1 / time periods)] -1.

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Yield to Maturity (YTM): Formula and Excel Calculator From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. In This Article What are the steps to calculating the yield to maturity (YTM) in Excel?

Coupon Bond Formula | How to Calculate the Price of Coupon ... Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as,

Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

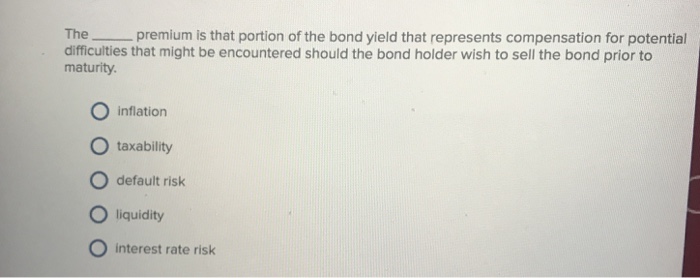

Explain Bonds, Bond Terms, Price and Yield, Types of Bond Risk - Arbor Asset Allocation Model ...

Yield to Maturity vs. Coupon Rate: What's the Difference? Yield to Maturity (YTM) The YTM is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same...

Coupon Bond - Guide, Examples, How Coupon Bonds Work equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased.

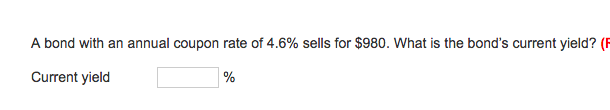

Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

How to Calculate Yield to Maturity: 9 Steps (with Pictures) F = the face value, or the full value of the bond. P = the price the investor paid for the bond. n = the number of years to maturity. Calculate the approximate yield to maturity. Suppose you purchased a $1,000 for $920. The interest is 10 percent, and it will mature in 10 years.

PDF Yield to Maturity - New York University Yield to Maturity 3 Yield of a Bond on a Coupon Date For an ordinary semi-annual coupon bond on a coupon date, the yield formula is where c is the coupon rate and T is the maturity of the bond in years. Annuity Formula Math result: Finance application: This formula gives the present value of an annuity of $1

exploringfinance.com › bond-duration-calculatorBond Duration Calculator - Exploring Finance Number of years to maturity is 2; Yield is 8% ; Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually; Bond price is 963.7; Based on the above information, here are all the components needed in order to calculate the Macaulay Duration: m = Number of payments per period = 2; YTM = Yield to Maturity = 8% or 0.08; PV ...

How to calculate yield to maturity in Excel (Free Excel ... Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%.

Solved "A zero-coupon bond has a yield to maturity of 5% ... "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. If the bond matures in 5 years, it should sell for a price of _____ today. "Question: "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. If the bond matures in 5 years, it should sell for a price of _____ today.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "45 yield to maturity of coupon bond"