39 government zero coupon bonds

What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ... Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1 Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value

› investors › insightsThe One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000.

Government zero coupon bonds

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy How to Invest in Zero-Coupon Bonds - US News & World Report Zero-coupon bonds live in the investing weeds, easily ignored by ordinary investors seeking growth for college and retirement. Even fixed-income investors may pass them by, because they don't... › country › united-kingdomUnited Kingdom Government Bonds - Yields Curve Last Update: 9 Aug 2022 14:15 GMT+0. The United Kingdom 10Y Government Bond has a 1.992% yield. 10 Years vs 2 Years bond spread is 9.7 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in August 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

Government zero coupon bonds. Government - Continued Treasury Zero Coupon Spot Rates* 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest that will be earned over the 10-year life ... › government-bondsGovernment Bonds: Types, Benefits & How to Buy ... - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. What are Zero coupon bonds? - INSIGHTSIAS What are Zero coupon bonds? Context: The government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the lender Rs 5,500-crore worth of non-interest bearing bonds valued at par. These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par. What Is a Zero-Coupon Bond? Definition, Advantages, Risks The US federal government, various municipalities, corporations, and financial institutions all issue zero-coupon bonds. The majority — what most people refer to as zeros — are US Treasury issues.... › terms › zZero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

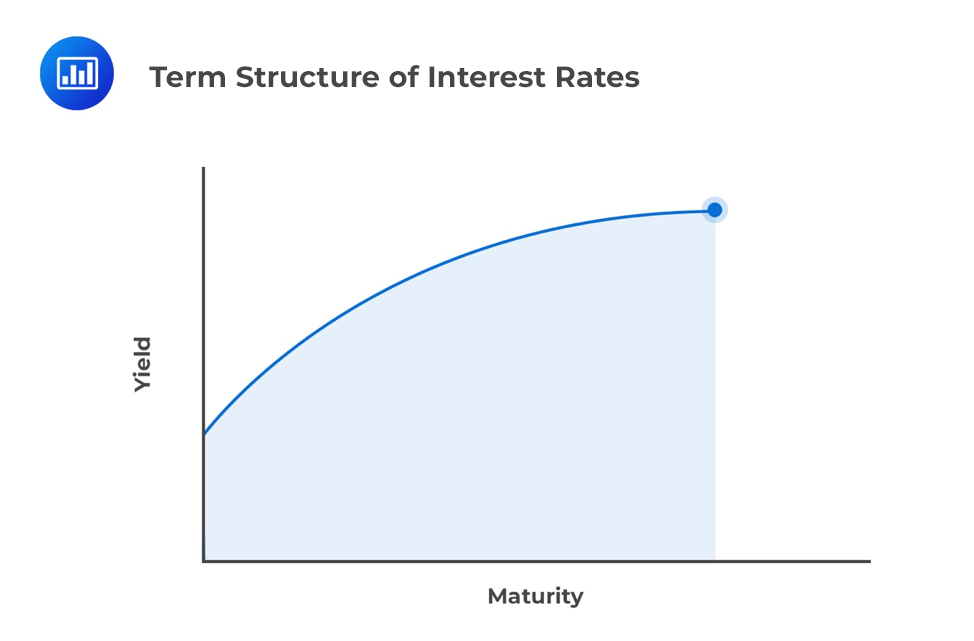

Zero Coupon Yield Curve - The Thai Bond Market Association 12.08. 17-Jun-2072. 49.884932. Remark: 1. The above yields are based upon average bids quoted by primary dealers, after 15% data cut-off from top and bottom when ranked by value. 2. Average bidding yields of 1-month, 3-month, 6-month and 1-year T-bills are bond equivalent yield converted from average simple yields. 3. United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.888% yield. 10 Years vs 2 Years bond spread is -32.7 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.50% (last modification in July 2022). The United States credit rating is AA+, according to Standard & Poor's agency. Current 5-Years Credit Default Swap ... Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips With a zero-coupon bond, you buy the bond at a discount from its face value, don't receive interest payments during the bond's term, and are paid the bond's face amount when it matures. For... Government, Zero-Coupon & Floating-Rate Bonds - Video & Lesson ... US savings bonds are one type of zero-coupon bond; these bonds do not make interest payments during the life of the bond. A commercial bond could also be structured as a zero-coupon bond.

› glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are commonly issued by governments. In this article, we will have a closer look at the pros and cons of zero-coupon bonds from an investor's point of view: Pros of Zero-Coupon Bonds. There are many zero-coupon bonds that are already in existence. Also, each year, many new zero-coupon bonds are issued. Despite there being so ...

Zero Coupon Muni Bonds - What You Need to Know - MunicipalBonds.com The largest benefit of zero coupon muni bonds is the low minimum investment since the securities are sold at a discount to face value. For example, a bond with a face value of $10,000 that matures in 20 years with a 5.5% coupon may be purchased for less than $5,000. This means that investors can purchase more face value at a lower upfront ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon government bonds can be purchased directly from the Treasury at the time they are issued. After the initial offering, they can be purchased on the open market through a brokerage account .

How Do I Buy Zero Coupon Bonds? | Budgeting Money - The Nest Step 5. Pay as little of the face value of your bond as you can to maximize your profit. For example, if a bond is worth $1,000 and you buy it for $800, you'll earn $200 in interest when the bond matures. But if you pay just $500 for the bond, you'll earn $500 at maturity. Zero coupon bond prices can fluctuate a great deal.

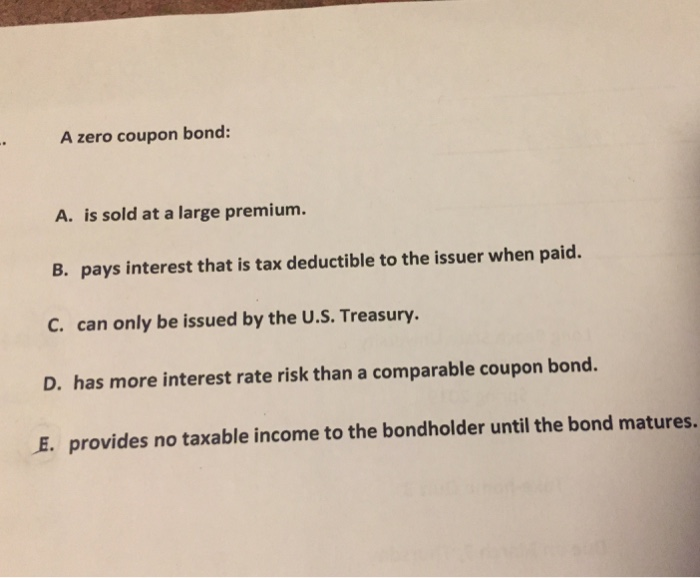

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Features of Zero-Coupon Bond. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return. Zero Coupon Bonds have no reinvestment risk however they carry interest rate risk. The accumulated interest is paid at the time of maturity. Includes a maturity period of 10 to 15 years.

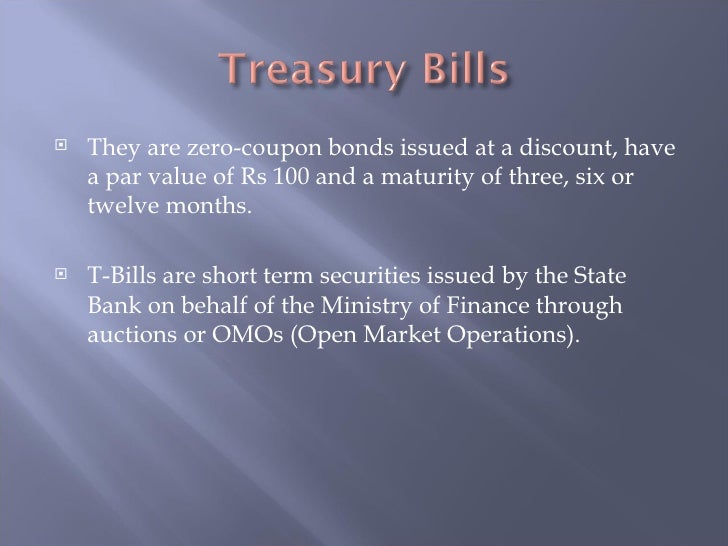

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity ...

Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Zero-Coupon Bond Price Formula To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000.

What Is a Zero Coupon Bond? | The Motley Fool Buy $10,000 worth of zero coupon bonds today, paying 3% interest and maturing in 2025, and you'll pay $7,441. Assuming the bond issuer pays as promised, you'll get back $10,000 in 2025. No worries...

ZERO COUPON GOVERNMENT BONDS - The Economic Times Govt's capital infusion via zero coupon bonds positive for PSU banks Issued at a deep discount to the face value, these bonds are non-interest bearing. This means it is an investment that does not earn any returns, but depreciates in value over the years.

What are Zero Coupon Bonds? - Civilsdaily Zero-Coupon Bonds These are non-interest bearing, non-transferable special GOI securities that have a maturity of 10-15 years and are issued specifically to Punjab & Sind Bank.

› country › united-kingdomUnited Kingdom Government Bonds - Yields Curve Last Update: 9 Aug 2022 14:15 GMT+0. The United Kingdom 10Y Government Bond has a 1.992% yield. 10 Years vs 2 Years bond spread is 9.7 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in August 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

How to Invest in Zero-Coupon Bonds - US News & World Report Zero-coupon bonds live in the investing weeds, easily ignored by ordinary investors seeking growth for college and retirement. Even fixed-income investors may pass them by, because they don't...

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "39 government zero coupon bonds"