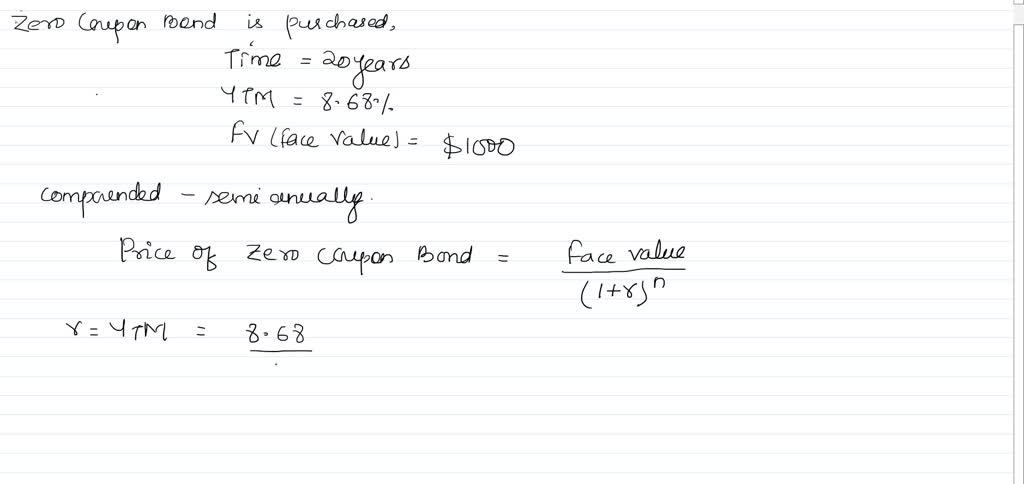

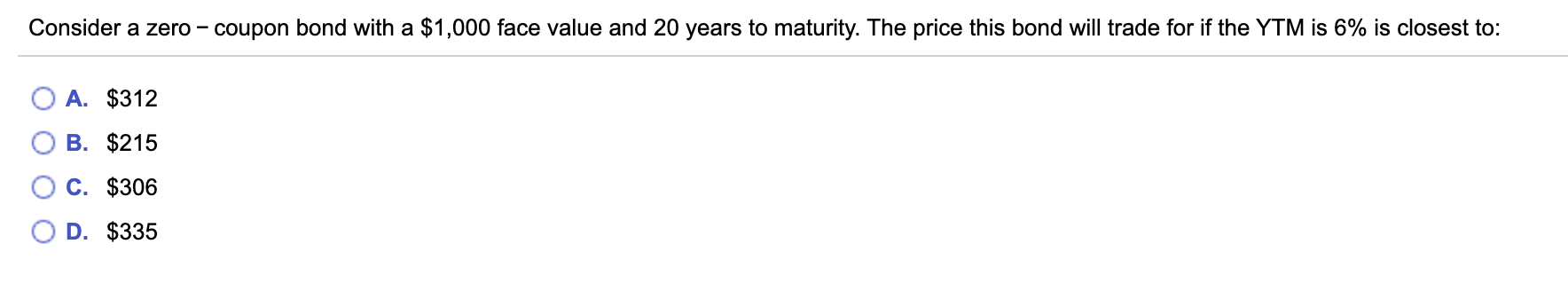

45 consider a zero coupon bond with 20 years to maturity

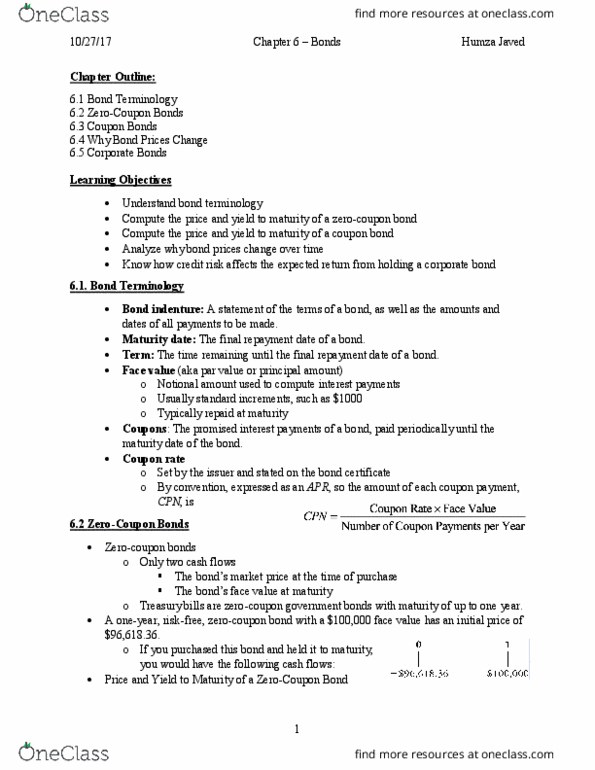

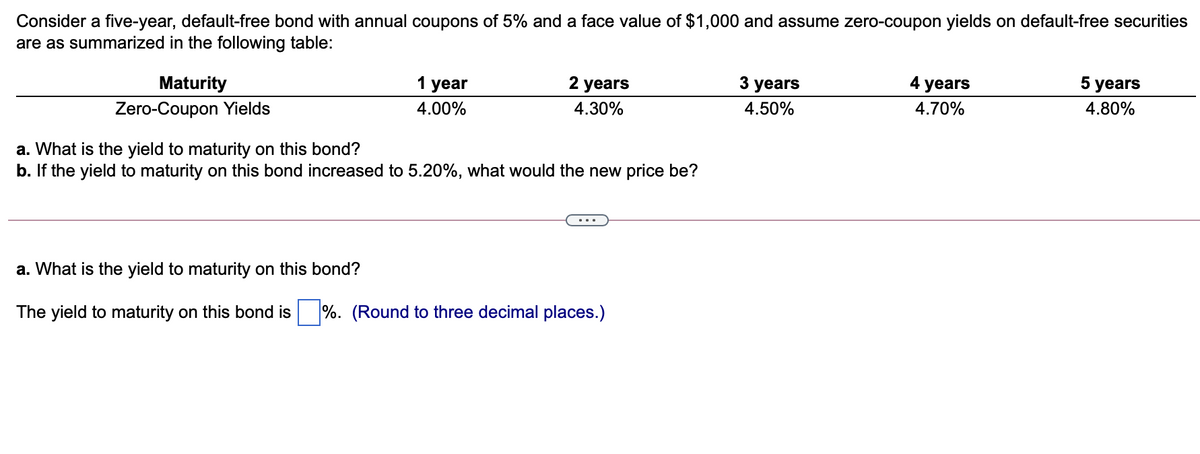

Bond duration - Wikipedia Consider a bond with a $1000 face value, 5% coupon rate and 6.5% annual yield, with maturity in 5 years. The steps to compute duration are the following: 1. Estimate the bond value The coupons will be $50 in years 1, 2, 3 and 4. Then, on year 5, the bond will pay coupon and principal, for a total of $1050. Problem Set #13 Solutions 1. All other things equal (YTM = 10 ... B. A 20-year bond with a 9% coupon. C. A 20-year bond with a 7% ... D. A 10-year zero-coupon bond ... Interest rates are currently 7%, but you believe the.

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

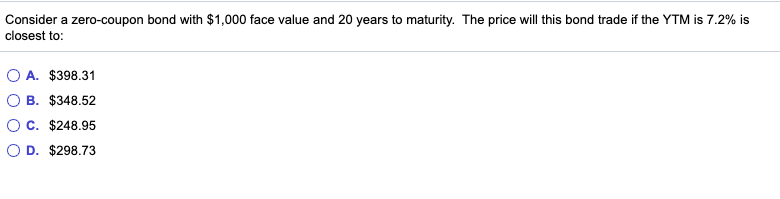

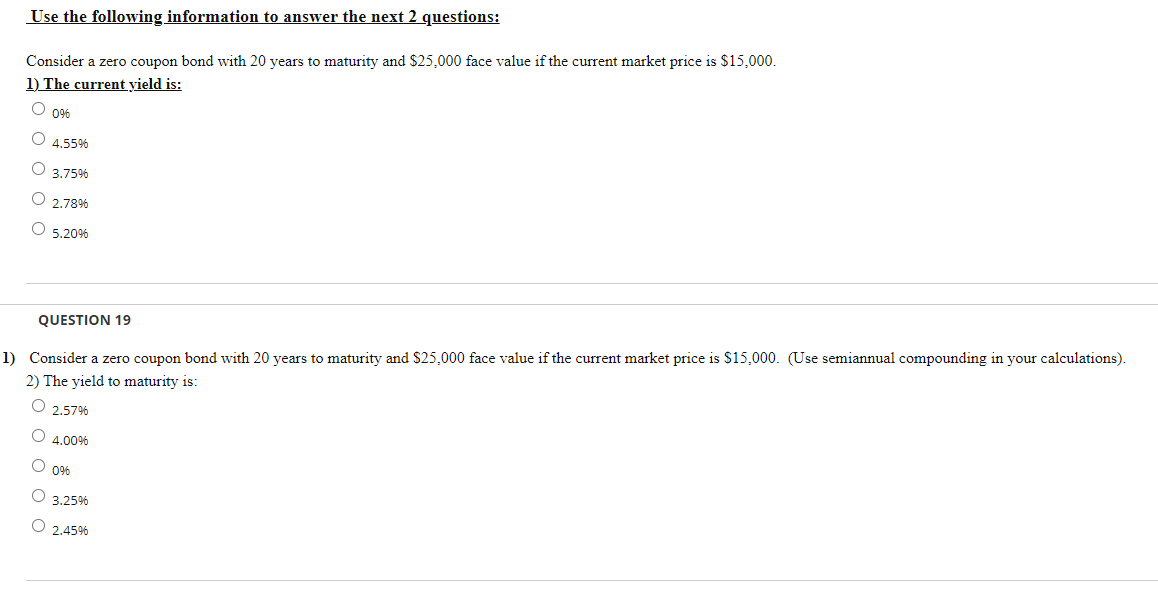

Consider a zero coupon bond with 20 years to maturity

Solved Consider a zero coupon bond with 20 years to | Chegg.com Question: Consider a zero coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from 7% to ... Course Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Solved Consider a zero-coupon bond with 20 years to | Chegg.com Question: Consider a zero-coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from ...

Consider a zero coupon bond with 20 years to maturity. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Thus, the most responsive bond has a long time to maturity (usually 20 to 30 years) and makes no interest payments. Therefore, long-dated zero-coupon bonds respond the most to interest rate changes. Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-Coupon Bond YTM Example. Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it ... Latest Business News | BSE | IPO News - Moneycontrol Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol.

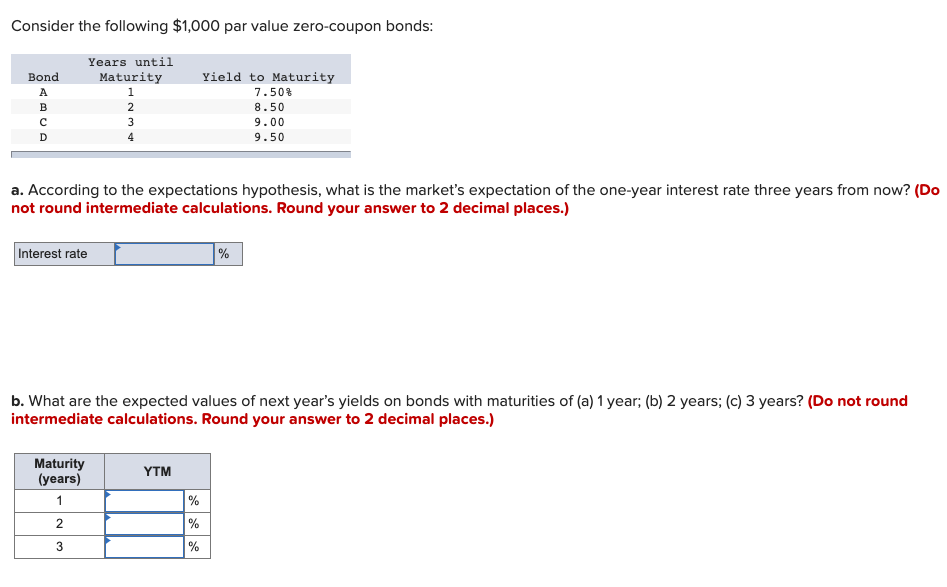

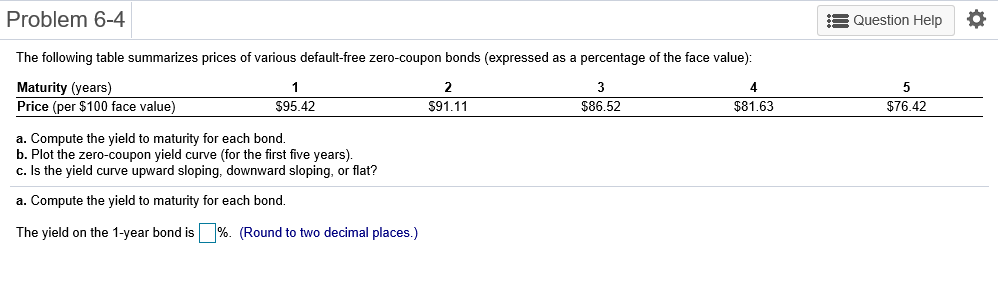

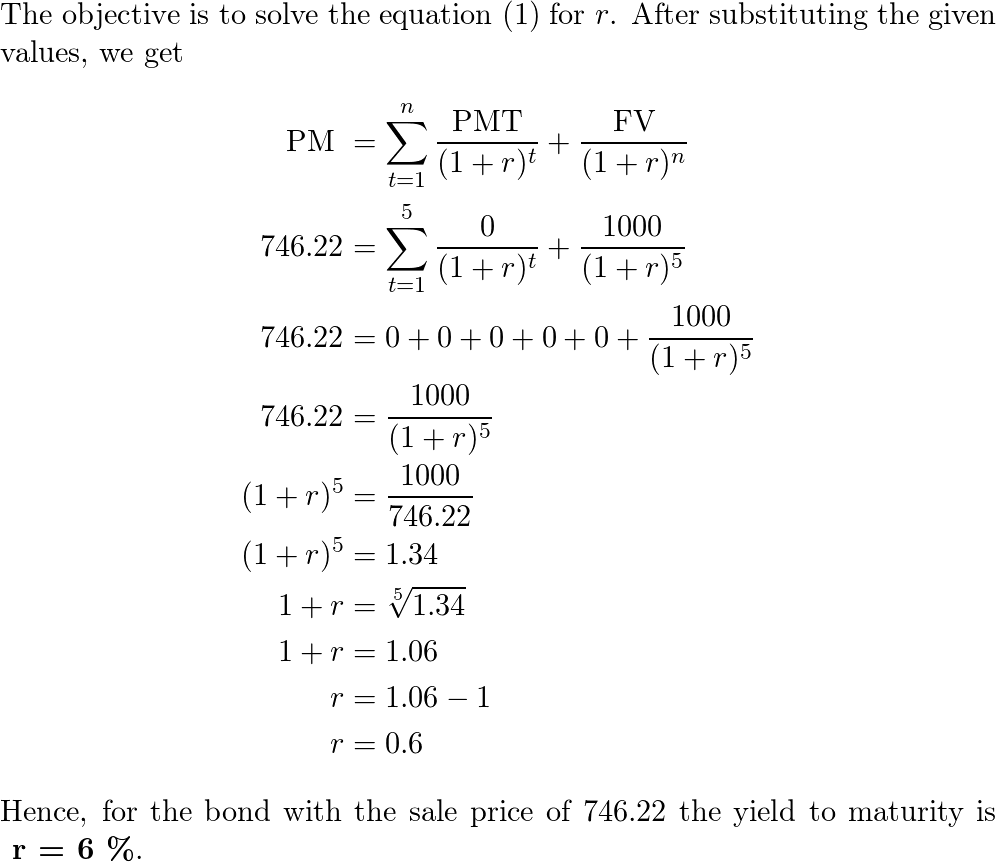

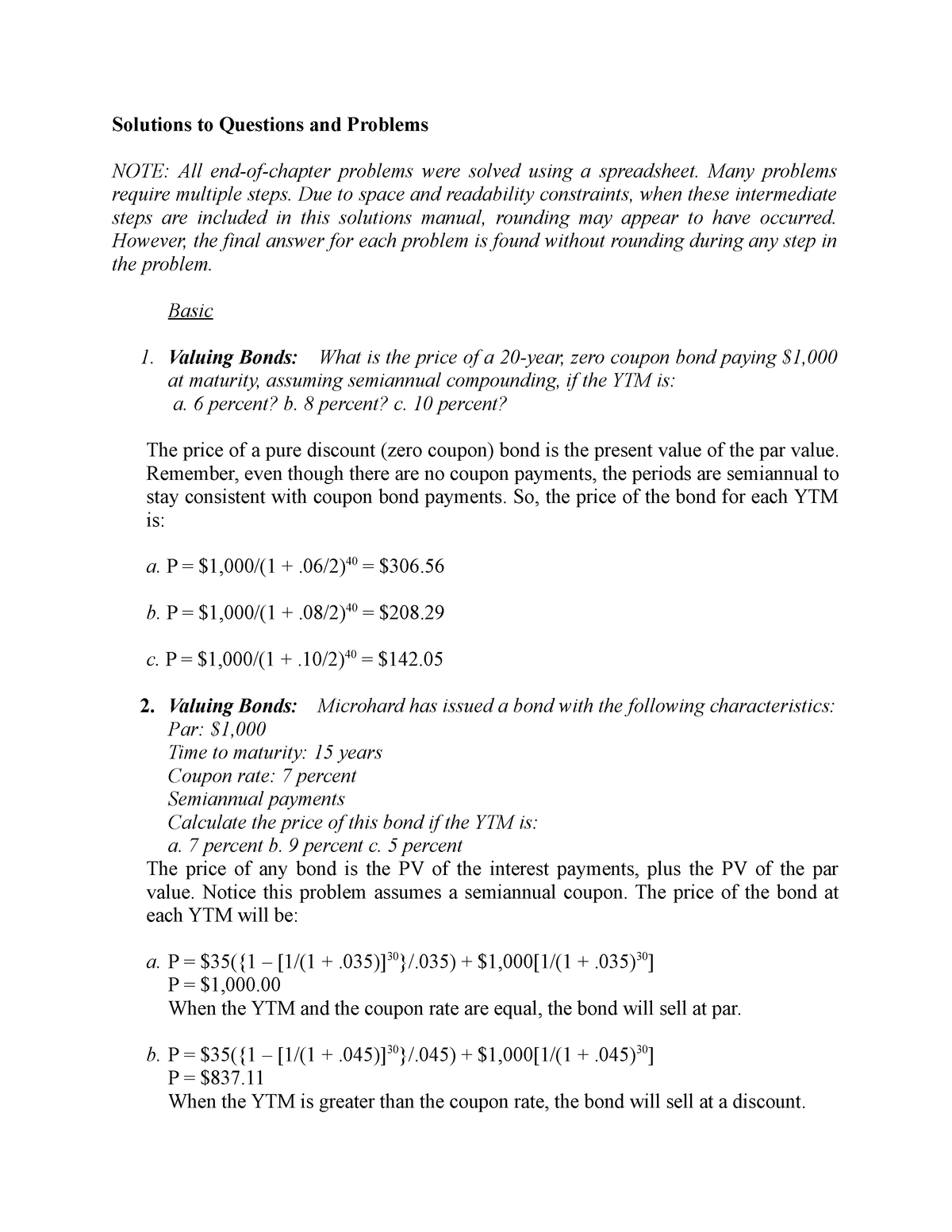

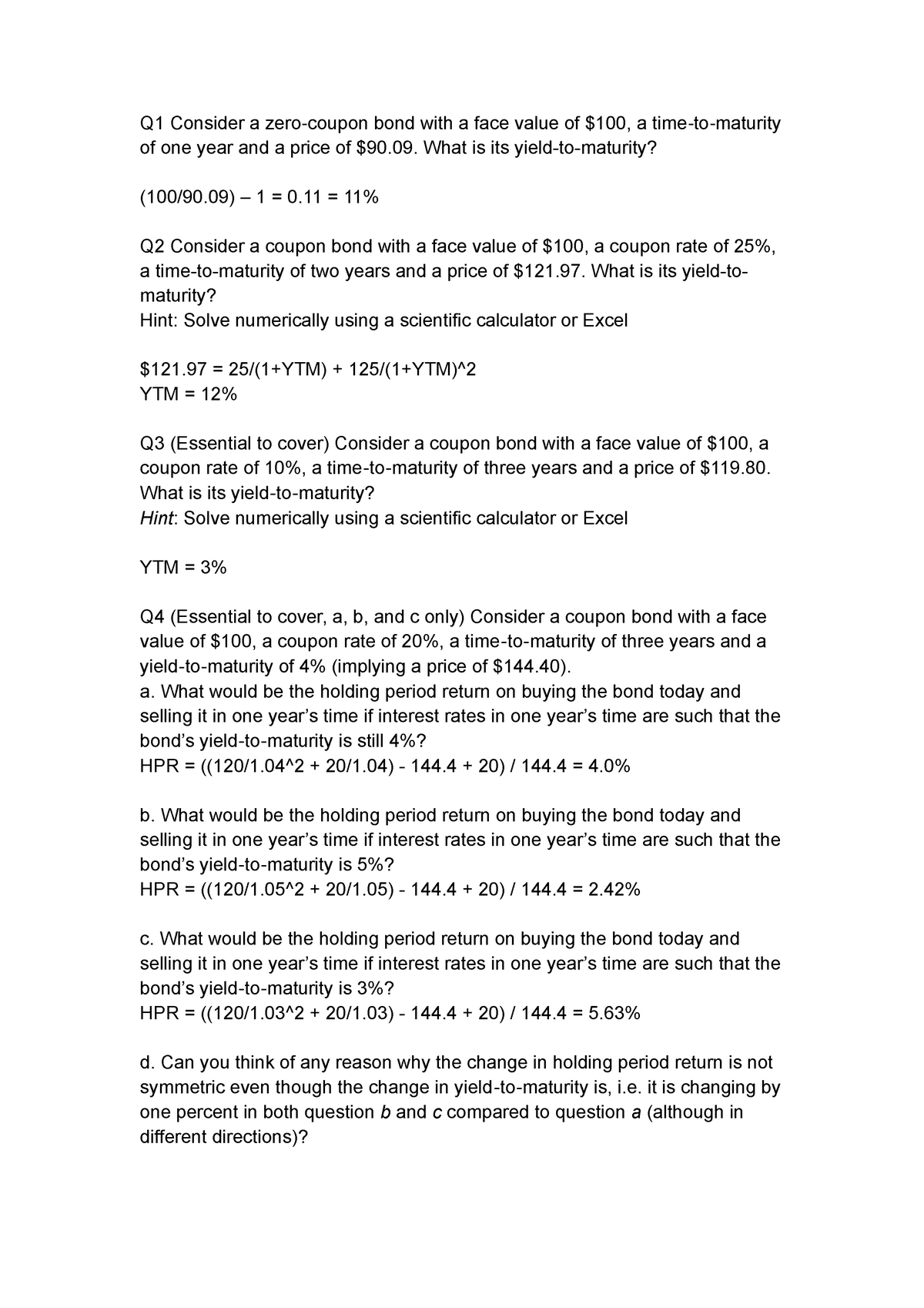

Econ 340, Fall 2011 Problem Set 2 Chapter 3 Quantitative Problems. 1. Calculate the present value of $1,000 zero-coupon bond with 5 years to maturity if the yield to maturity is 6%. Solution:. Chapter 06 - used t read it - Corporate Finance, 3e (Berk/DeMarzo ... Consider a zero coupon bond with 20 years to maturity. The percentage change in the price of the bond if its yield to maturity decreases from 7% to 5% is ... Consider a zero coupon bond with 1000 face value and - Course Hero Compute PV =N)i1(FV =10)0.1041(1000 = 371.8020) Consider a zero-coupon bond with a $1000 face value and ten years left until maturity. If the bond is ... Consider a zero coupon bond with 20 years to maturity ... - Study.com Answer to: Consider a zero coupon bond with 20 years to maturity. The percentage change in the price of the bond if its yield to maturity decreases...

Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Example of a Zero-Coupon Bonds Example 1: Annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? 5 = $783.53. The price that John will pay for the bond today is $783.53. Example 2 ... Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Consider an example where a bond pays a coupon of 5%. All issuances of this bond are sold at par value. Then, macroeconomic conditions in the world worsen, and the Federal Reserve begins lower the ... CH 5 Problems - Bonds Problems A bond pays $80 per year in ... (note, zero coupon bonds do not. pay any interest) (Review Chapter 3)?. 3. Consider the two bonds described below: Bond A Bond B. Maturity 15 yrs 20 yrs. Solved Consider a zero-coupon bond with 20 years to | Chegg.com Question: Consider a zero-coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from ...

Course Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

Solved Consider a zero coupon bond with 20 years to | Chegg.com Question: Consider a zero coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from 7% to ...

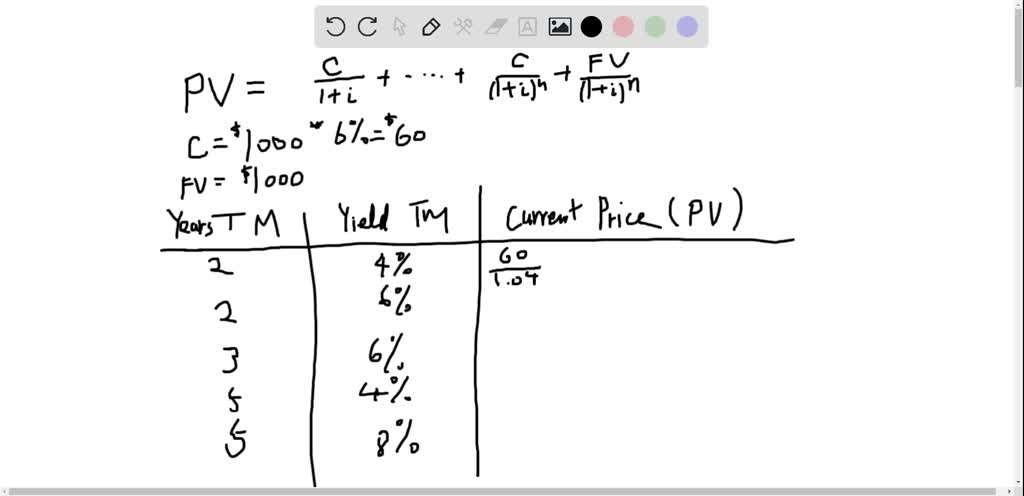

Consider a bond with a 6 % annual coupon and a face value of 1,000 . Complete the following table. What relationships do you observe between years to maturity, yield to maturity, and the current ...

:max_bytes(150000):strip_icc():format(webp)/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "45 consider a zero coupon bond with 20 years to maturity"