42 yield to maturity of zero coupon bond

Zero Coupon Bonds - Financial Edge Training Oct 8, 2020 ... Zero coupon bonds are different since they do not pay investors any interest payments between issuance and maturity. 12. The current yield curve for default-free zero-coupon bonds is as ... If market expectations are correct, what will the yield curve on one- and two-year zero-coupon bonds be next year? Maturity (Years). Price. YTM.

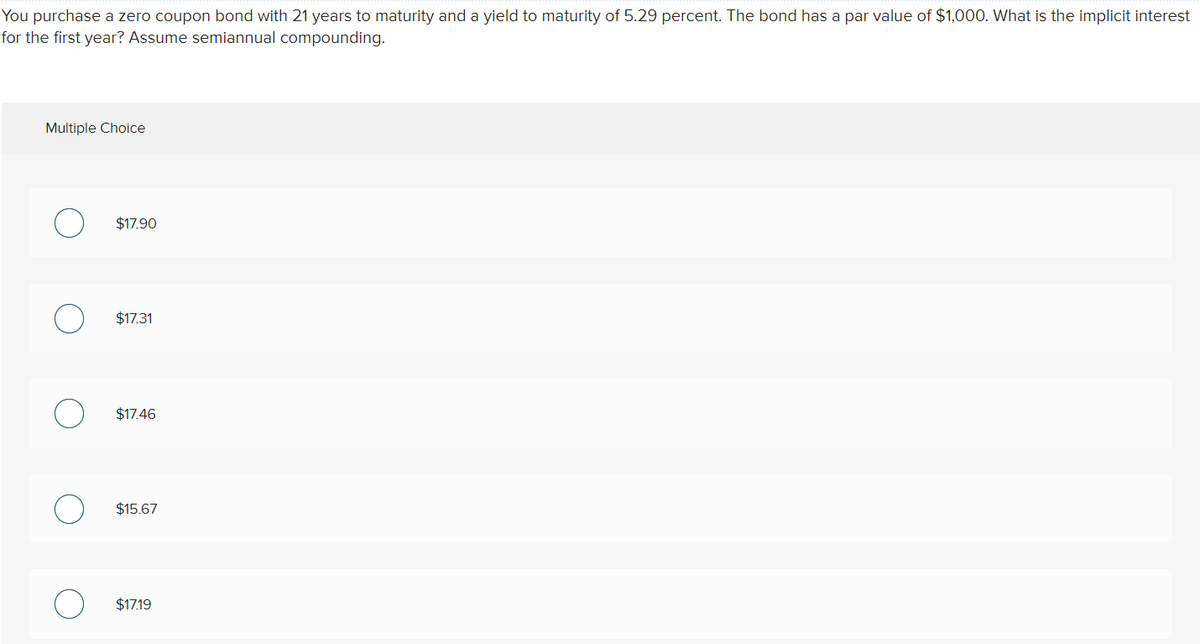

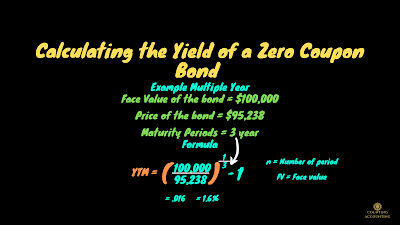

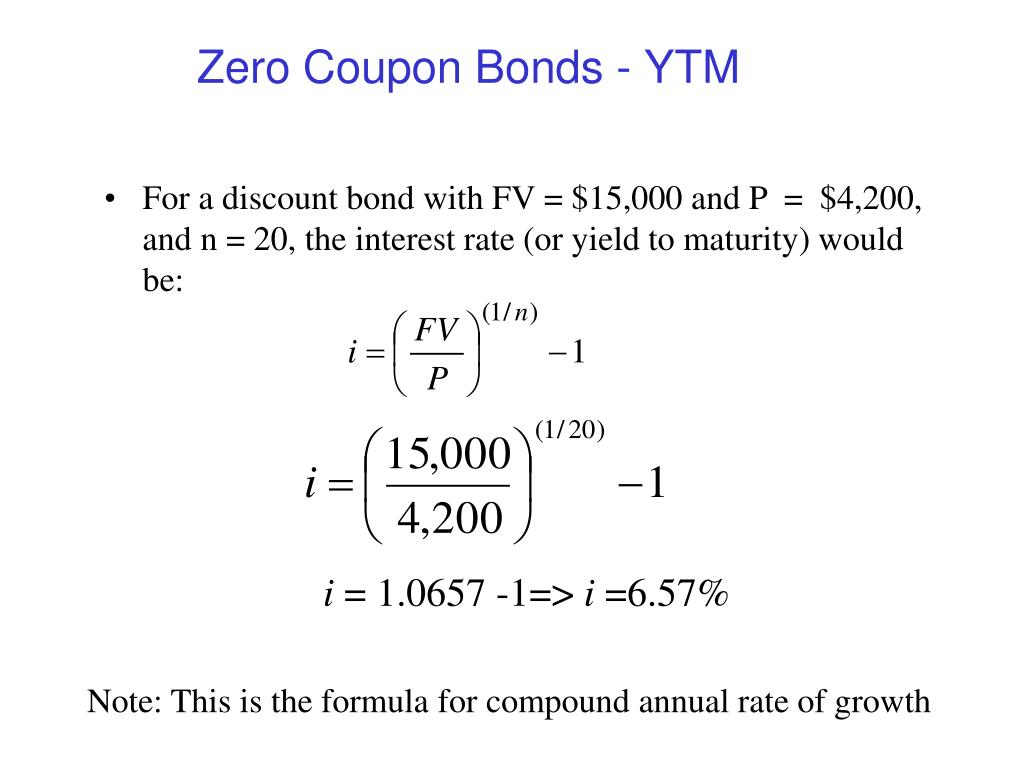

Zero-Coupon Bonds: Characteristics and Examples To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV).

Yield to maturity of zero coupon bond

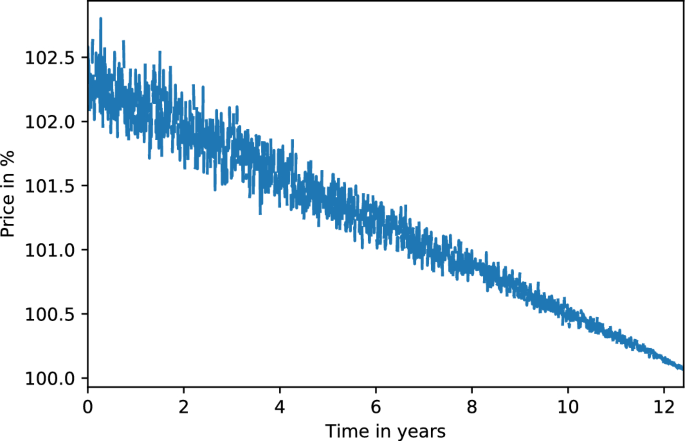

Yield to Maturity – What it is, Use, & Formula - Speck & Company There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / ... Fitted Yield on Zero Coupon Bonds by Maturity, Monthly | FRED Release Tables: Fitted Yield on Zero Coupon Bonds by Maturity, Monthly · 1 Year, 4.4567, 4.4046, 0.2701 · 2 Year, 4.5156, 4.4608, 0.5319 · 3 Year, 4.4236, 4.3676 ... Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep ...

Yield to maturity of zero coupon bond. Yield to Maturity - NYU Stern Therefore, zero rates imply coupon bonds yields and coupon bond yields imply zero yields. Page 5. Debt Instruments and Markets. Professor Carpenter. Yield to ... How to Calculate The Yield To Maturity of A Zero Coupon Bond Jun 6, 2021 ... In this video I will explain what a zero coupon bond is and show you how to use the formula to calculate the yield to maturity of a zero ... Zero Coupon Bond Yield - Financial Formulas (with Calculators) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. · YTM takes into account the regular coupon ...

Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep ... Fitted Yield on Zero Coupon Bonds by Maturity, Monthly | FRED Release Tables: Fitted Yield on Zero Coupon Bonds by Maturity, Monthly · 1 Year, 4.4567, 4.4046, 0.2701 · 2 Year, 4.5156, 4.4608, 0.5319 · 3 Year, 4.4236, 4.3676 ... Yield to Maturity – What it is, Use, & Formula - Speck & Company There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / ...

Post a Comment for "42 yield to maturity of zero coupon bond"