43 suppose you bought a bond with an annual coupon of 7 percent

1.docx - Suppose you bought a bond with an annual coupon rate of 7.9 ... View 1.docx from FIN 737 at Columbus State Community College. Suppose you bought a bond with an annual coupon rate of 7.9 percent one year ago for $902. The bond sells for $936 Suppose you bought a bond with an annual coupon of 7 percent one year ... Value of bond one year ago = $1,010. Annual coupon rate = 7%. Selling value of bond today = $985. Face value = $1,000. (a) Total dollar return on this investment: = Current bond price - Last year price + Coupon payment. = $985 - $1,010 + ($1,000 × 7%) = $985 - $1,010 + $70. = $45.

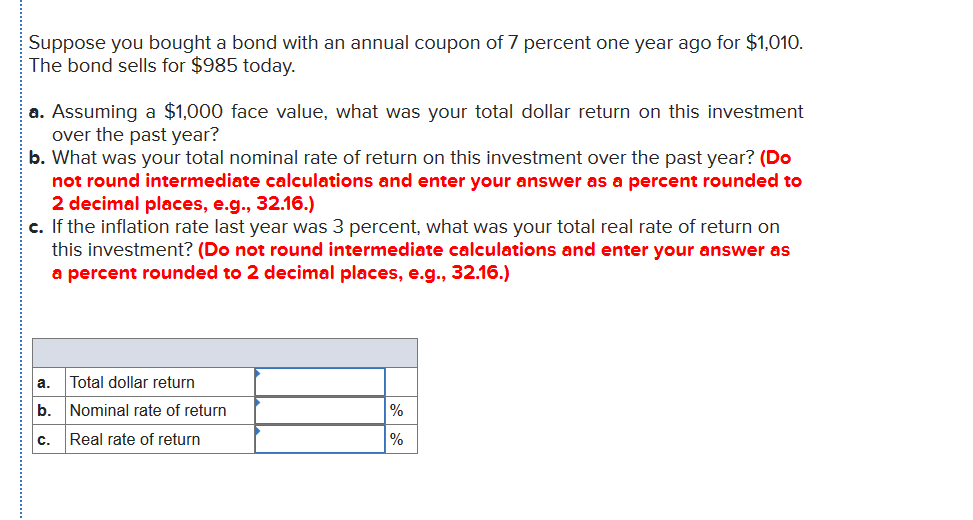

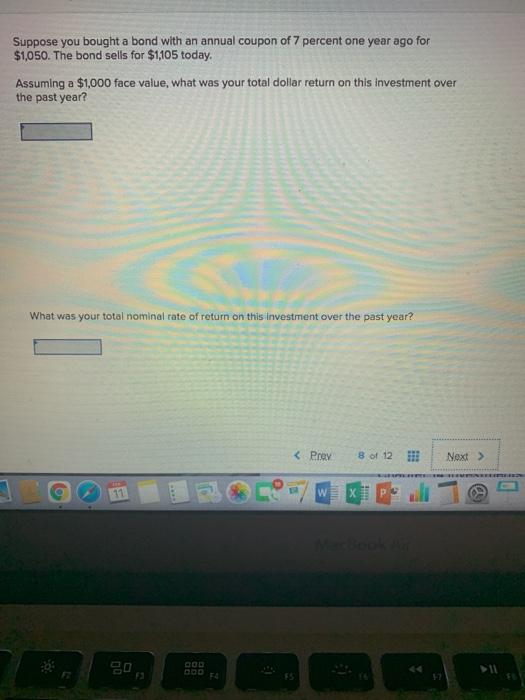

Calculating returns suppose you bought a bond with an - Course Hero Calculating Returns Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? What was your total nominal rate of return on this investment over the past year? If the inflation rate last year was 3 percent, what was your total real rate of return on this investment?

Suppose you bought a bond with an annual coupon of 7 percent

Solved Suppose you bought a bond with an annual coupon rate - Chegg Question: Suppose you bought a bond with an annual coupon rate of 7.2 percent one year ago for $895. The bond sells for $922 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) 1.) Suppose you bought a bond with an annual coupon rate of 1.) Suppose you bought a bond with an annual coupon rate of 8.4... 1.) Suppose you bought a bond with an annual coupon rate of 8.4 percent one year ago for Suppose you bought a bond with an annual coupon of 7 percent... get 5 Answer of Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value,...

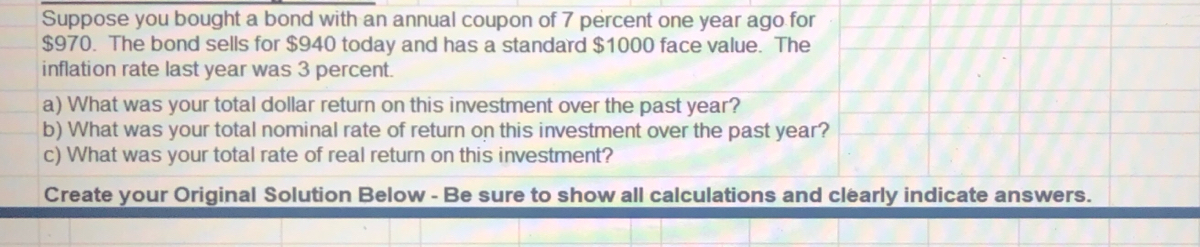

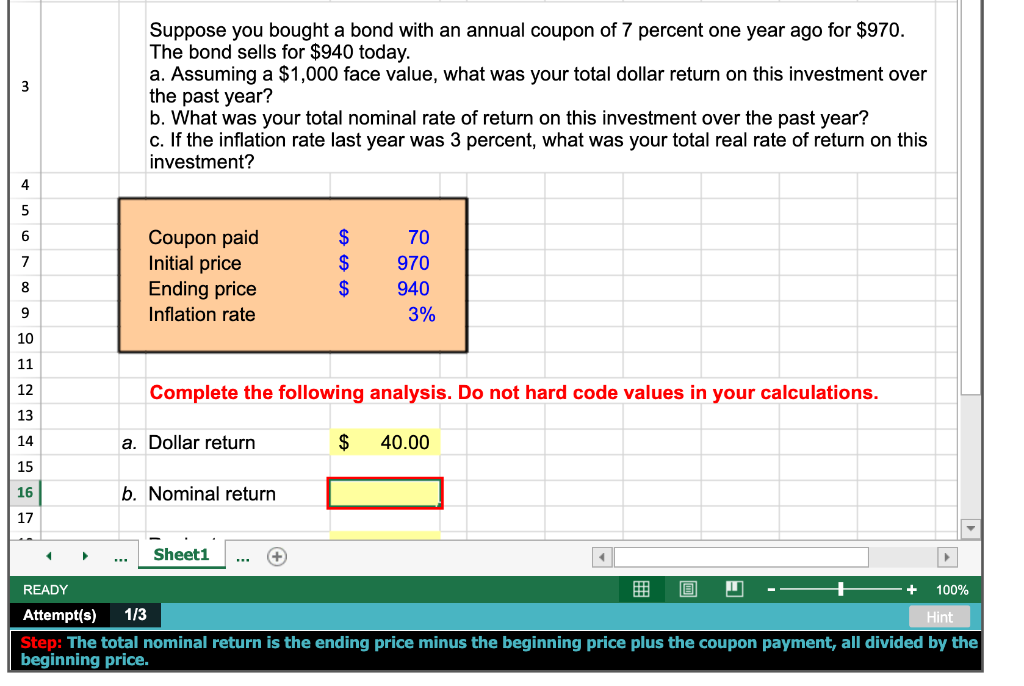

Suppose you bought a bond with an annual coupon of 7 percent. Suppose you bought a bond with an annual coupon of 7 percent Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. Subject: Business Price: 2.87 Bought 7. Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? Suppose you bought a bond with an annual coupon of 7 percent one year ... We will write a custom Essay on Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond… specifically for you for only $16.05 $13/page. 805 certified writers online Calculating returns. Suppose you bought a bond with an annual coupon of ... Calculating returns. Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today.a. Assuming $1,000 face value, what was your total dollar return on this investment over the past year?b. What was your total nominal rate of return on this investment over the past year?c. fin370-suppose-you-bought-a-bond-with-an-annual-coupon-of-7-percent (5/4)- Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? c.

Solved > Suppose you bought a 8 percent coupon bond:174345 ... | ScholarOn Suppose you bought a bond with a coupon rate of 7.5 percent oneyear ago for $898. The bond sells for $928 today. 1) Assuming a $1,000... Suppose you bought a bond with a coupon rate of 7.6 percent oneyear ago for $899. The bond sells for $930 today. Required: (a)Assuming a... Suppose You Bought A Bond With An Annual Coupon Rate Of 6 5 Percent One ... Suppose you bought a bond with an annual coupon rate of 6.5 percent one year ago for $1,032. The bond sells for $1,020 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment […] Bond Price Calculator Example of a result Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84 Suppose you bought a bond with an annual coupon rate of 7...get 5 Answer of Suppose you bought a bond with an annual coupon rate of 7 percent one year ago for $860. The bond sells for $890 today. a. Assuming a $1,000 face...

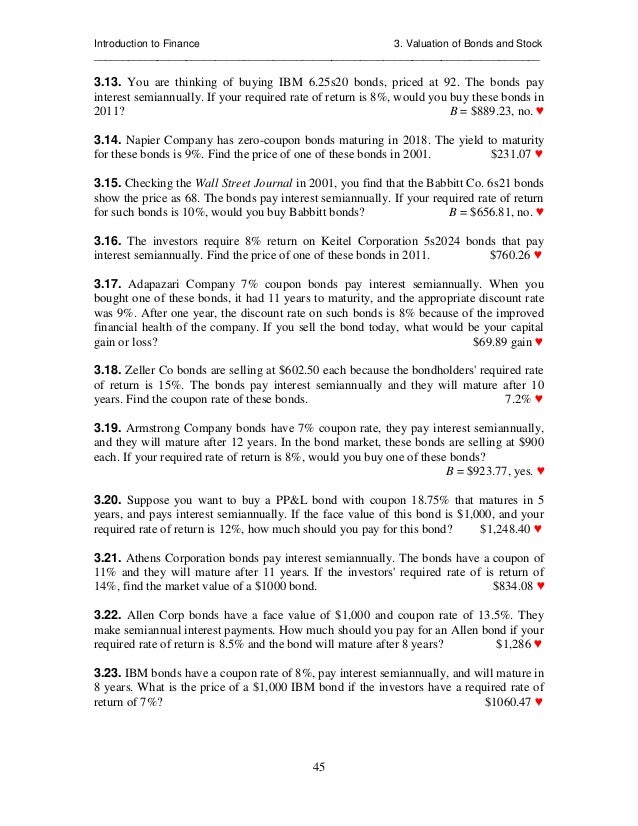

Finance Final Exam chapters 10,11,12,&13 Flashcards | Quizlet Suppose you bought a bond with an annual coupon rate of 7.9 percent one year ago for $902. The bond sells for $936 today. a. assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. what was your total nominal rate of return on this investment over the past year? c. if the inflation rate last year was 4.4 percent, what was your total real rate of return on this investment? Question : Question Suppose you bought a bond with an annual coupon ... Suppose you bought a bond with an annual coupon rate of 8 percent one year ago for $903. The bond sells for $938 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Total dollar return $ Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? Bond Coupon Interest Rate: How It Affects Price - Investopedia When the prevailing market rate of interest is higher than the coupon rate—say there's a 7% interest rate and a bond coupon rate of just 5%—the price of the bond tends to drop on the open...

Solved Suppose you bought a bond with an annual coupon of 7 - Chegg Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? (Do not round intermediate calculations; Question: Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today.

Suppose you bought a bond with an annual coupon of 7... - en.ya.guru Annual coupon rate = 7%. Selling value of bond today = $985. Face value = $1,000 (a) Total dollar return on this investment: = Current bond price - Last year price + Coupon payment = $985 - $1,010 + ($1,000 × 7%) = $985 - $1,010 + $70 = $45 (b) Nominal rate of return on this investment: = [(Current bond price - Last year price + Coupon payment) ÷ Last year price]

Answered: 4. Calculating Returns [LO1] Suppose… | bartleby Calculating Returns [LO1] Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? c.

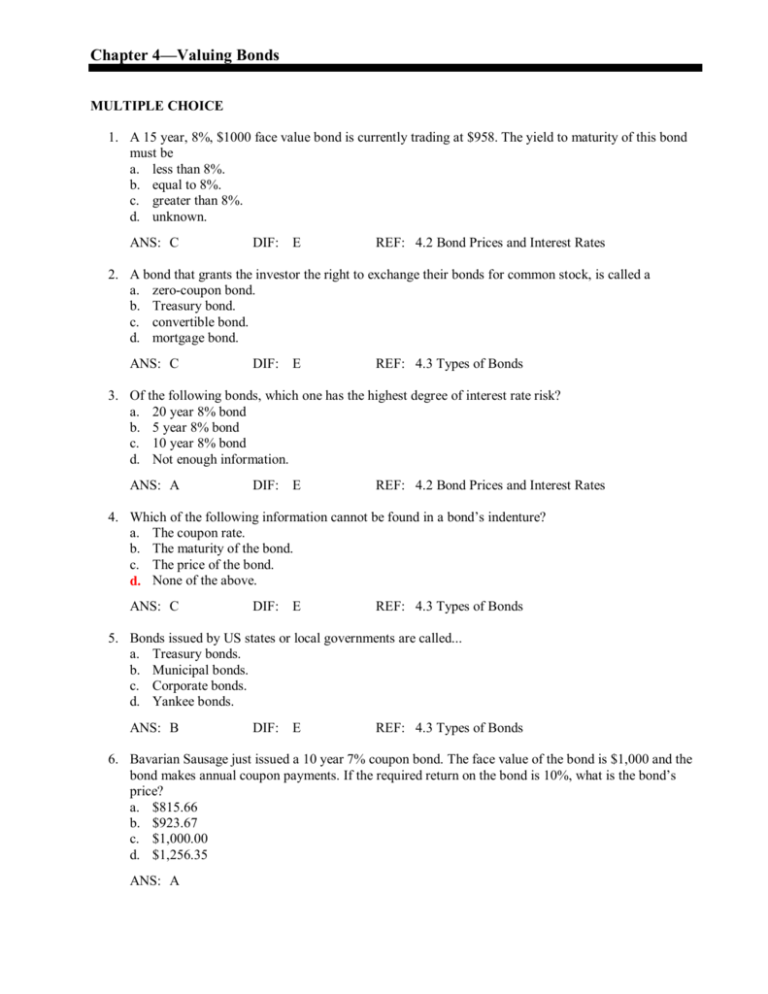

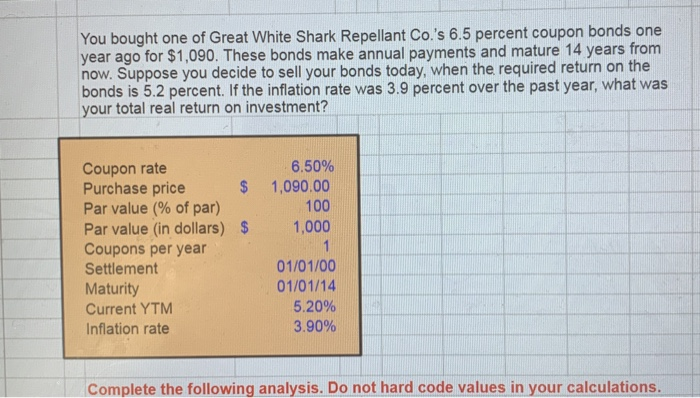

Chapter 10 Finance Flashcards | Quizlet To find the return on the coupon bond, we first need to find the price of the bond today. Since the bond has 7 years to maturity, the price today is: You received the coupon payments on the bond, so the nominal return was: R = .0627, or 6.27% And using the Fisher equation to find the real return, we get: r = (1.0627 / 1.044) - 1 r = .0179, or 1.79%

Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar ret - на ВсеЗнания ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a ...

[Solved] Suppose you bought a bond with an annual | SolutionInn Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? c.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia Most bonds pay interest semi-annually, which means bondholders receive two payments each year. 1 So with a $1,000 face value bond that has a 10% semi-annual coupon, you would receive...

Answered: Suppose you bought a bond with an… | bartleby Business Finance Suppose you bought a bond with an annual coupon rate of 8.9 percent one year ago for $912. The bond sells for $956 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b.

Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a 8 percent (annually) coupon bond one year ago for $880. The bond sells for $910 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over ; Suppose you bought a 4 percent (annually) coupon bond one year ago for $800. The bond sells for $850 today. a.

[Solved] Suppose you bought a bond with an annual coupon of 7 percent ... Answer to Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today. a. Assuming a $1,000 face value, what was you | SolutionInn

Suppose you bought a bond with an annual coupon of 7 percent... get 5 Answer of Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value,...

1.) Suppose you bought a bond with an annual coupon rate of 1.) Suppose you bought a bond with an annual coupon rate of 8.4... 1.) Suppose you bought a bond with an annual coupon rate of 8.4 percent one year ago for

Solved Suppose you bought a bond with an annual coupon rate - Chegg Question: Suppose you bought a bond with an annual coupon rate of 7.2 percent one year ago for $895. The bond sells for $922 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

![Solved . Calculating Returns [LO1] Suppose you bought a bond ...](https://media.cheggcdn.com/media%2F38b%2F38b38db3-3702-4add-a10f-4ff659ba85af%2FphpsDljP0.png)

Post a Comment for "43 suppose you bought a bond with an annual coupon of 7 percent"