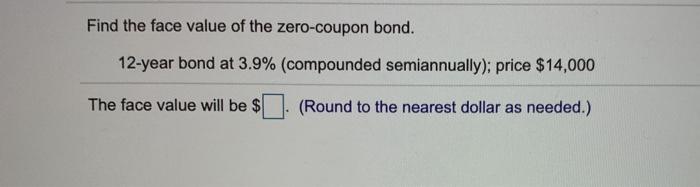

44 find the face value of the zero coupon bond

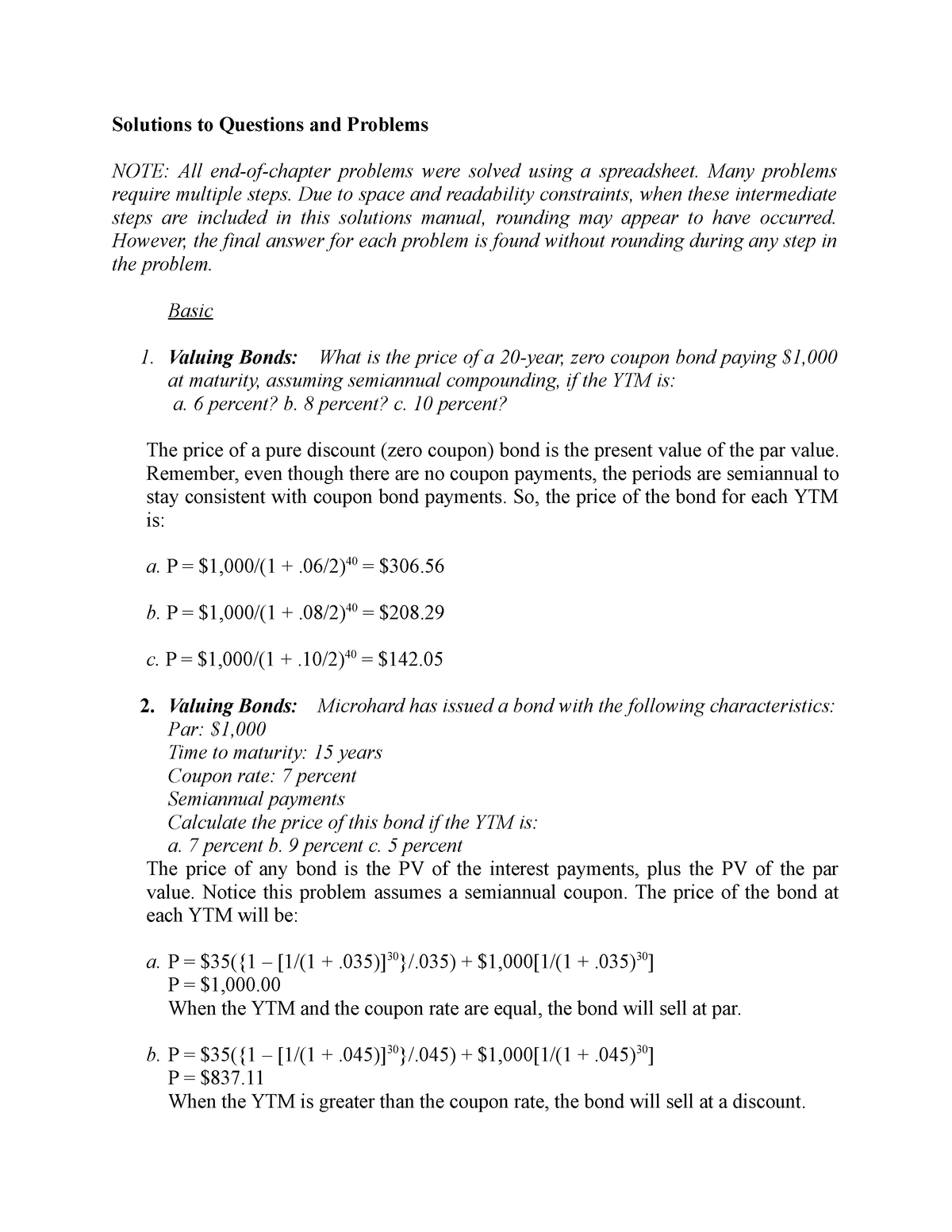

Zero-Coupon Bonds: Characteristics and Calculation Example To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes Zero Coupon Bond | Definition, Formula & Examples - Study.com Feb 18, 2022 ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 ...

Find the face value to the nearest thousand dollars of the 15 year zero ... Compute the issue price of each of the following bonds. \\ a. $1,000,000 face value, zero coupon bonds due in 20 years, priced on the market to yield 10% compounded semiannually. b. $1,000,000 face value, serial bonds repayable in equal semiannual install; Suppose the price of a 2-year zero coupon bond with face value of $10,000 is equal to ...

Find the face value of the zero coupon bond

Zero Coupon Bond Value Formula - Crunch Numbers Let's assume an investor wants to buy a zero-coupon bond and wants to evaluate what YTM of this bond would be. The face value of the bond is $10,000. The price of the bond is $9,100. There are 2 years until maturity. YTM = \sqrt [2] { \frac {10,000} {9,100} } - 1 = 4.83\% Y T M = 2 9,10010,000 −1 =4.83% YTM of this bond is 4.83%. 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting If a bond is issued for $37,000 and the company eventually repays the face value of $40,000, the additional $3,000 is interest on the debt. That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds. How to Calculate the Price of a Zero Coupon Bond Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00 00:00.

Find the face value of the zero coupon bond. Zero Coupon Bond Value Calculator - Find Formula, Example & more A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5. When we solve the equation barely by hand or use the ... Zero Coupon Bond Value Calculator - BuyUpside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield ... Zero Coupon Bond Calculator – What is the Market Value? - DQYDJ The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000 What Is the Face Value of a Bond? - SmartAsset A bond's coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond's face value on its maturity date.

Zero Coupon Bond Calculator - MiniWebtool When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t Where: F = face value of bond r = rate or yield t = time to maturity Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. How do you find the present value of a coupon bond? As shown in the formula, the value, and/or original price, of the zero coupon bond is discounted to present value. To find the zero coupon bond's value at its original price, the yield would be used in the formula. After the zero coupon bond is issued, the value may fluctuate as the current interest rates of the market may change. Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

What Is a Zero-Coupon Bond? | The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond =... 17012877.pdf - Name: Ozodbek Id: 17012877 1) CH 15. PROBLEM... PROBLEM SETS #16 Suppose that a 1-year zero-coupon bond with face value $100 currently sells at $94.34, while a 2-year zero sells at $84.99. You are considering the purchase of a 2-year-maturity bond making annual coupon payments. The face value of the bond is $100, and the coupon rate is 12% per year a) What is the yield to maturity of the 2 ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Valuation of Zero-Coupon Bonds - YouTube Mar 22, 2020 ... This video provides an explanation of a zero-coupon bond and proceeds to show how the value and yield are calculated using manual ...

How to Calculate the Price of Coupon Bond? - WallStreetMojo = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

Zero-Coupon Bond: Definition, How It Works, and How To Calculate The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until...

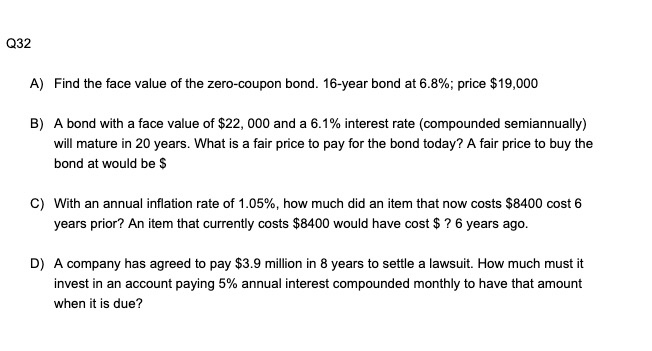

Solved Find the face value of the zero-coupon bond. | Chegg.com Question: Find the face value of the zero-coupon bond. 20-year bond at 5.95 %; price $9050 The face value of the zero-coupon bond will be $ ____. (Round to the nearest dollar as needed.) This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period

Solved Find the face value of the zero-coupon bond. 15-year | Chegg.com Find the face value of the zero-coupon bond. 15-year bond at 3.3%; price $3000 The face value will be $. (Do not round until the final answer. Then round to the nearest dollar as needed.) A six-month $4800 treasury bill sold for $4562. What was the simple annual discount rate? The discount rate was %.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US ...

Calculate Zero-coupon Bond Purchase Price If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation.

How to Calculate Face Value of a Bond in Excel (3 Easy Ways) - ExcelDemy 1. Using Coupon to Calculate Face Value of a Bond in Excel. For the first method, we will use the multiplication of the coupon ( c) by the number of compounding per year ( n ), and then divide it by the Annual Coupon Rate to calculate the face value of a bond. Our formula will look like this.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww A zero-coupon bonds pays no interest and trade at a discount to its face value. Get to know its meaning, advantages, price calculation. ... The time and the maturity value of Zero Coupon bonds share a negative correlation. The longer until the maturity date, the less the investors have to pay for it. Therefore, the Zero Coupon bonds generally ...

Zero Coupon Bond Value - Financial Formulas (with Calculators) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... When the bond reaches a maturity date (the end of the bond period), the holder is entitled to receive the face value (a stated amount) of the ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased...

Zero Coupon Bond Calculator - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term.

How to Calculate the Price of a Zero Coupon Bond Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00 00:00.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting If a bond is issued for $37,000 and the company eventually repays the face value of $40,000, the additional $3,000 is interest on the debt. That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds.

Zero Coupon Bond Value Formula - Crunch Numbers Let's assume an investor wants to buy a zero-coupon bond and wants to evaluate what YTM of this bond would be. The face value of the bond is $10,000. The price of the bond is $9,100. There are 2 years until maturity. YTM = \sqrt [2] { \frac {10,000} {9,100} } - 1 = 4.83\% Y T M = 2 9,10010,000 −1 =4.83% YTM of this bond is 4.83%.

Post a Comment for "44 find the face value of the zero coupon bond"