38 difference between coupon rate and market rate

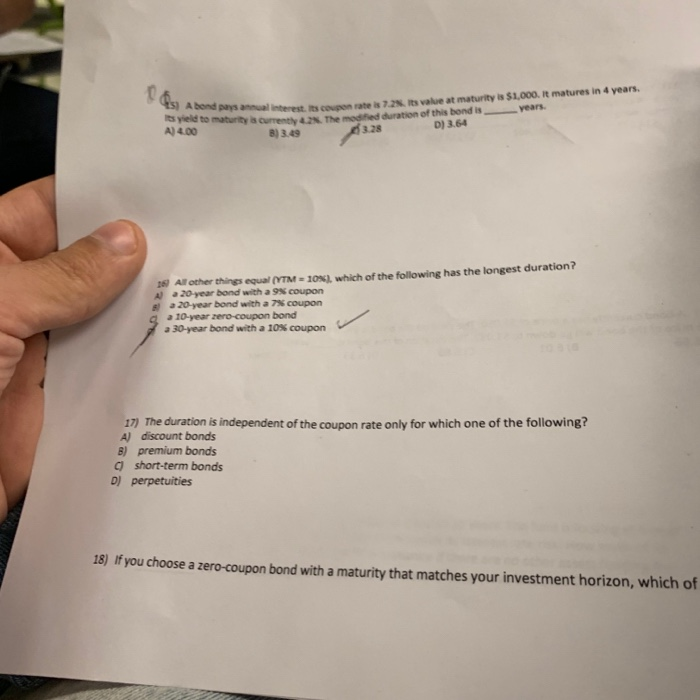

Finance exam 2 Flashcards | Quizlet It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features. Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1.

Difference between coupon rate and market rate

When is a bond's coupon rate and yield to maturity the same? Defining the Coupon Rate, Maturity Date, and Market Value of Bonds ... The coupon rate of a bond is its interest rate, or the amount of money it pays the ... Coupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Discount Rate vs Interest Rate | 7 Best Difference (with ... Both Discount Rate vs Interest Rate are popular choices in the market; let us discuss some of the major Difference Between Discount Rate vs Interest Rate: The interest rate is the amount charged by a lender to a borrower for the use of assets. The lenders here are the banks and the borrowers are the individuals.

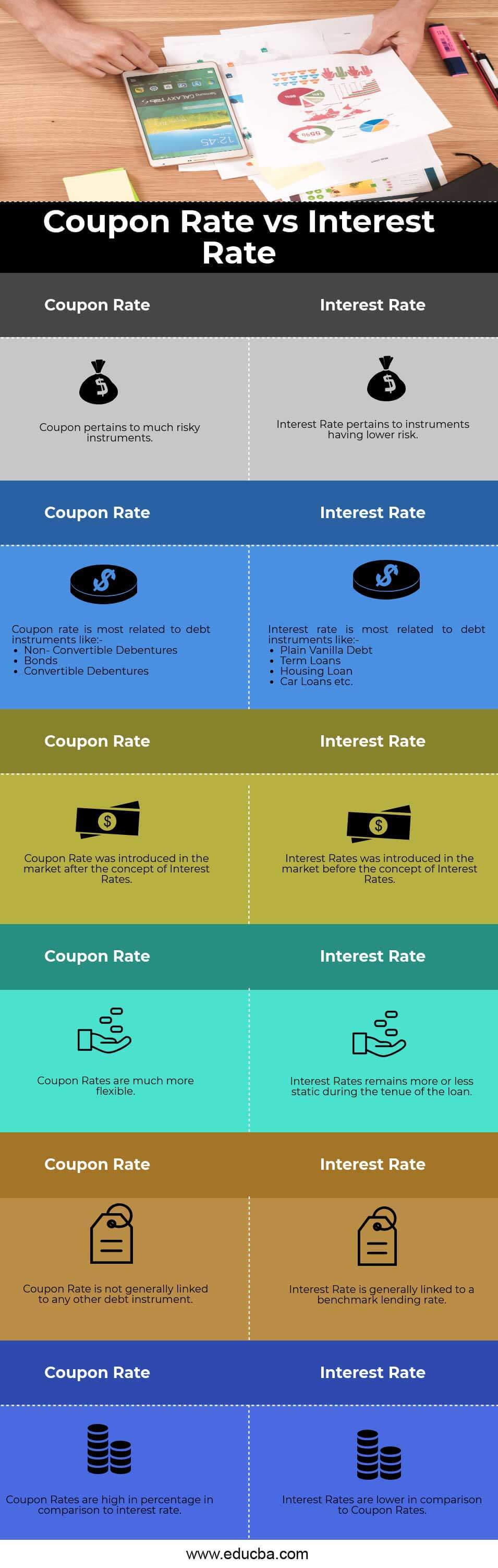

Difference between coupon rate and market rate. Coupon vs Yield | Top 5 Differences (with Infographics) On the basis of the coupon payment and face value of the bond, the coupon rate is calculated. The yield of the bond, on the other hand, is the interest rate on the basis of the current market price of the bond and is thus also known as the effective rate of return for a bond. Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. Coupon vs Yield | Top 8 Useful Differences (with Infographics) While calculating the current yield, the coupon rate compares to the current market price of the bond. During the tenure of the bond, the bond price remains the same till maturity due to the continuous fluctuation of the market price; it is better to buy a bond at the discount rate which offers handsome returns on the maturity at face value. Difference Between Nike and Adidas Feb 24, 2022 · Main Differences Between Nike and Adidas. Nike has a greater reach worldwide than Adidas. Nike has more market capitalisation than Adidas and in 2019 it had almost double market capitalization than Adidas. Nike has more social media number than Adidas.

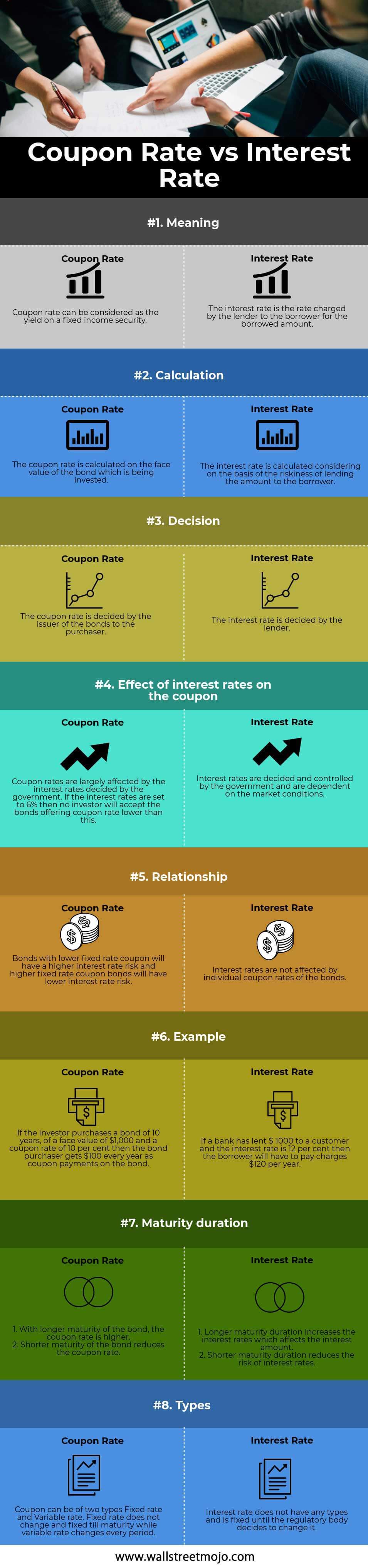

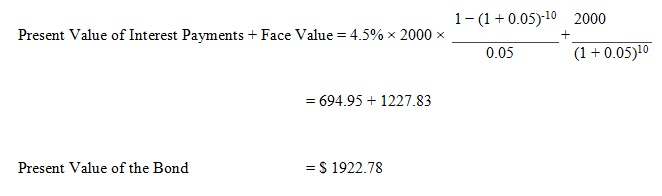

What is Coupon Rate? Definition of ... - The Economic Times What is 'Coupon Rate' Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Difference Between Coupon Rate and Required Return The coupon rate does is independent of the market value. The required return is dependent on the dividend value. The coupon rate is directly dependent on the bond price, whereas the required return is directly dependent on the risk involved. Coupon Rate has a risk on investment due to the fluctuations of the coupon rate. Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

What is the difference between coupon rate and market A coupon rate is the yield paid by a fixed income security, a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bonds face or par value. The coupon created the yield the bond paid on its issue date. Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Bonds - Coupon and Market Rates Differ - YouTube Lesson discussing how the value of a bond changes when coupon rates and market rates differ. Looks at why a bond will trade at a premium, discount, or at pa... What’s the Difference Between Premium Bonds and Discount ... Jun 02, 2021 · A discount bond, in contrast, has a coupon rate lower than the prevailing interest rate for that bond maturity and credit quality. An example may clarify this distinction. Let’s say you own an older bond—one that was originally a 10-year bond when you bought it five years ago. This bond has a 5% coupon rate and you want to sell it now.

Difference Between Coupon Rate and Interest Rate • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender.

The Difference between a Coupon and Market Rate Solution Preview. Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond.

Difference Between LED and QLED Jun 24, 2019 · Difference Between LED and QLED Television displays have been rapidly evolving since the inception of LCD technology in the late 1990s which almost kicked the CRT business out of the market. The world was only beginning to understand the LCD technology that LEDs surfaced which changed the course of history. First it was LCD, then LED, and now ...

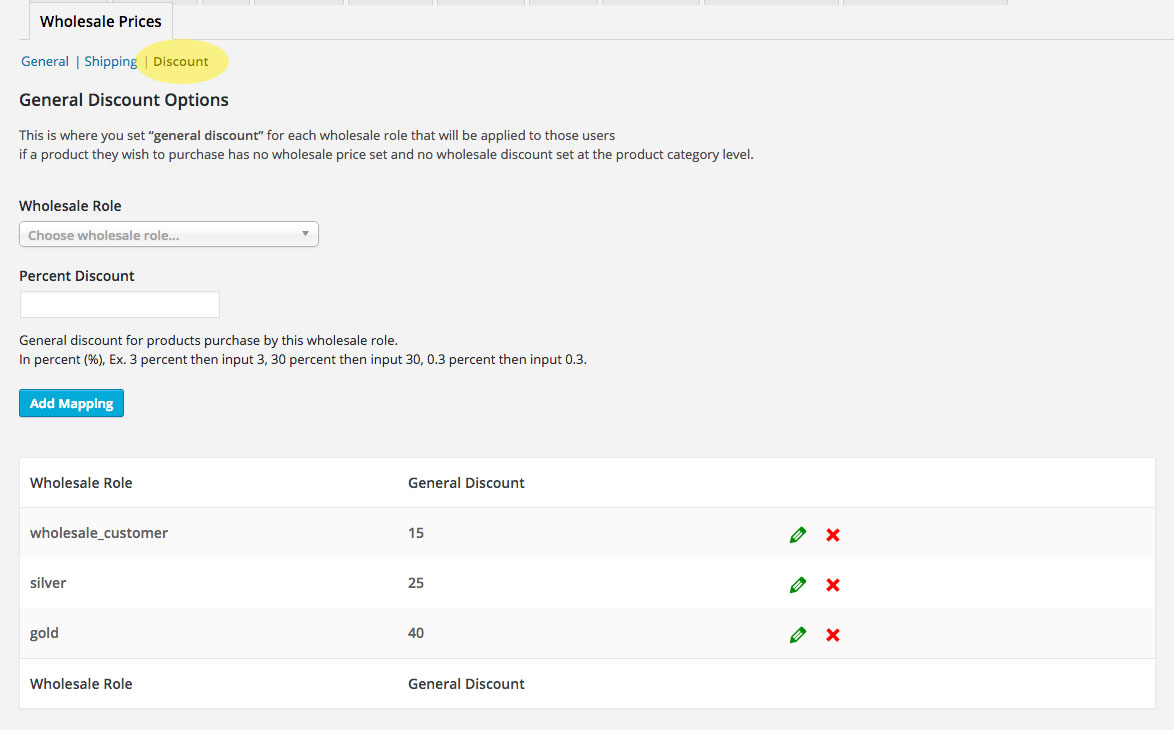

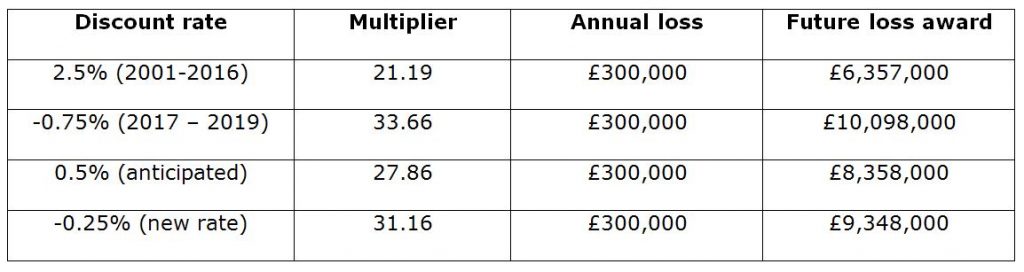

Difference Between Coupon Rate and Discount Rate Coupon Rate vs Discount Rate. The main difference between the Coupon rate and the Discount rate is that a Coupon rate alludes to the rate which is determined on the face worth of the security, i.e., it is the yield on the proper pay security that is generally affected by the public authority set Discount rates, and it is usually settled by the backer of the guards while Discount rate alludes to the rate which is charged to the borrower by the moneylender, chosen by the bank, and it is ...

What's the difference between the cost of debt and a coupon rate? Answer: When a company sets out to issue debt in the capital markets, there are two primary factors that can make its cost of debt different from the coupon rate. First (and potentially smaller) is the cost of issuance - it has to pay someone to structure and market the bond (usually a broker-dea...

Difference Between IRR and Discount Rate Jun 02, 2019 · The discount rate is a required return by active investors in the local real estate marketplace for investments in properties of similar type and risk. The higher the perceived risk of a property investment, the higher the discount rate used by investors in estimating the present value of its future cash flows. Note that the present value of a ...

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate. A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

Solved What is the difference between a bond's coupon rate | Chegg.com The market rate is the rate specified on the face of the bond. The coupon rate is the rate of return expected by Investors who purchase the bonds. The coupon rate is the effective rate of interest. The market rate is the maximum rate of return company can pay. Previous question Next question

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · When a bond's yield differs from the coupon rate, this means the bond is either trading at a premium or a discount to incorporate changes in market condition since the issuance of the bond.

Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author.

Coupon Rate - Meaning, Calculation and Importance - Scripbox This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail. ... couponrates have an impact on bond prices. When the interest rates in the market are higher than the bond's couponrate, the bond prices fall. In other words, since interest rates are higher than ...

What is the difference between the coupon rate and market rate? What is the difference between the coupon rate and market rate? No. of Words. 539. PRICE. $5.00. User Ratings. 0/5. 0 ratings. 0 ratings X.

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics

Solved What is the difference between a bond's coupon rate | Chegg.com Experts are tested by Chegg as specialists in their subject area. We review their content and use your feedback to keep the quality high. 100% (2 ratings) A bond's coupon rate is the actual amount of interest income that the holder of a bond earns each year. The coupon rate ….

Difference Between Coupon Rate And Interest Rate Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

Coupon Rate vs Interest Rate - WallStreetMojo A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and it is manipulated by the government depending totally on the market conditions

What is difference between coupon rate and interest rate? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates.

Post a Comment for "38 difference between coupon rate and market rate"