42 zero coupon bond journal entry

Original Issue Discount (OID) - CFAJournal The bond issuers offer a higher discount on zero-coupon bonds. Zero-coupon bonds do not pay regular interest payments to the investors instead the investors look to realize profits with capital gains. If the bonds do not sell the investor's only return with a zero-coupon bond with OID is the difference in the face value at maturity and ... Malaysian Government Bond: Characters And... | 123 Help Me Examples for zero coupon bonds include Malaysian Treasury Bills (MTB). ... For the pre-valued bonds, which means when the cash received is equal to the maturity value. The journal entry for issuing bonds, first, debit the cash; second, credit the bond payable. The journal entry for interest payment is debit the interest expense and credit the cash.

Zero Coupon Bond Journal Entries - thmc.info Zero Coupon Bond Journal Entries - Zero Coupon Bond Journal Entries, Deals Horseshoe Valley Resort, Navy Pier Winter Wonderfest Coupon Codes, Best Deals Samsung Galaxy S2 Sim Free, Free Mobile Recharge Coupons Reliance Gsm, Holiday Deals New Orleans, Joann Fabrics Coupons Printable May 2020

Zero coupon bond journal entry

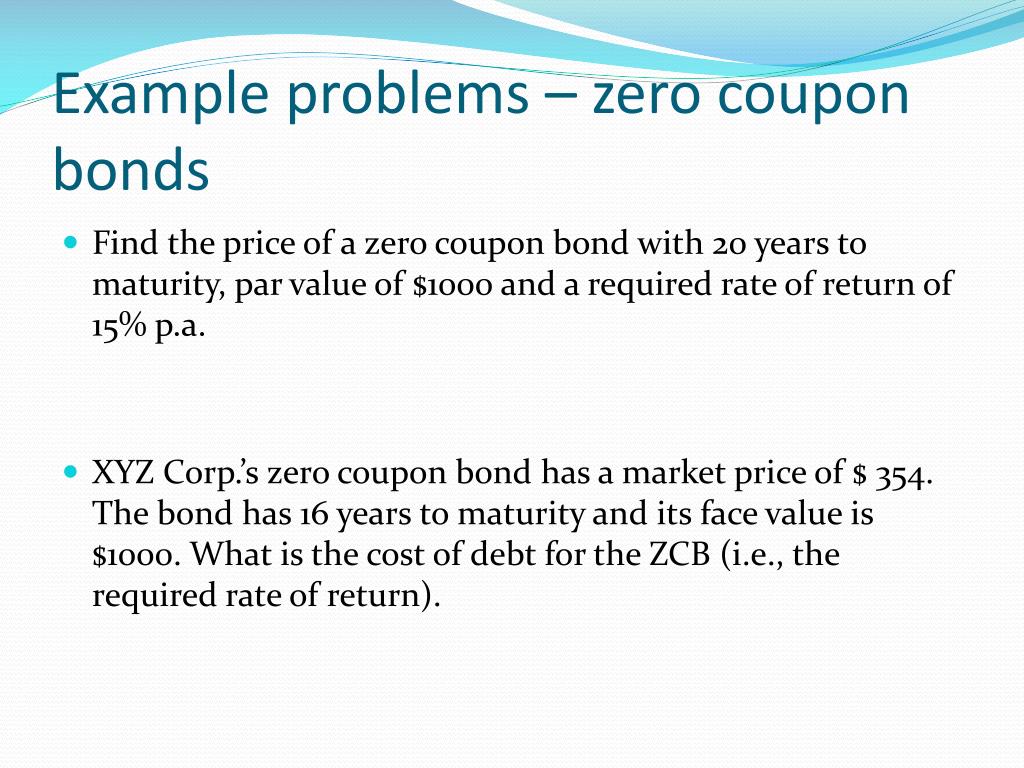

Related Accounting Q&A - bartleby On January 1, 2021, Darnell Window and Pane issued $18 million of 10 year, zero-coupon bonds for $5,795,518.Required:1. Prepare the journal entry to record the bond issue.2. Determine the effective rate of interest.3. Prepare the journal entry to record annual interest expense at December 31, 2021.4. Accounting Deep Discount Bonds - CAclubindia A. Zero Coupon Bond (Deep Discount Bond) Zero-coupon bond (also called a discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond. How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero coupon bond journal entry. 14 Classification of Transactions in Zero-Coupon Bonds, Junk ... by R MC — An obvious problem in accounting for zero-coupon bonds is that, because the entire income is generated through the discount, the cost of providing the capital ... Accounting Zero Coupon Bonds Journal Entries Accounting Zero Coupon Bonds Journal Entries - Accounting Zero Coupon Bonds Journal Entries, Spirit Cruise Coupon Washington Dc, Giordano's Coupon, Baby Toys Coupons Walmart, Deals On French Lick Hotels, Jcpenney $10 Off Coupon Code December 2020, Dfds Amsterdam Deals Assume a firm issues a zero-coupon bond on 1/1/2021 ... Assume a firm issues a zero-coupon bond on 1/1/2021. The face value is $10,000,000, and the effective rate is 5.94%, compounded annually over the 40 years of the bond Make the amortization table Make the journal entry to issue the bonds on 1/1/2021 Make the entry to record interest on 12/31/2021 and 12/31/2022 Recording Entries for Bonds - Lumen Learning ProfessorBDoug's Bond Discount Journal Entry For our example assume Jan 1 Carr issues $100,000, 12% 3-year bonds for a price of 95 1/2 or 95.50% with interest to be paid semi-annually on June 30 and December 30 for cash. We know this is a discount because the price is less than 100%. The entry to record the issue of the bond on January 1 would be:

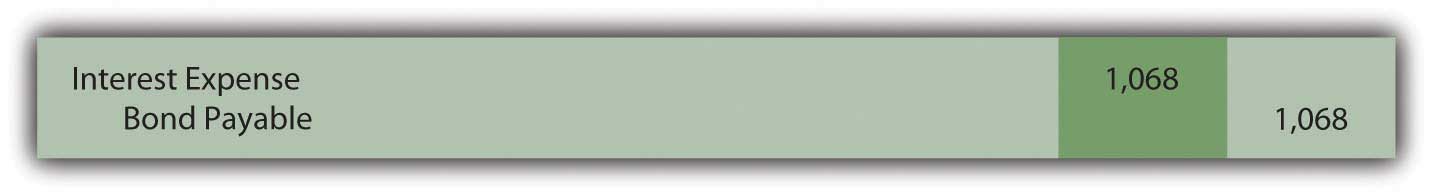

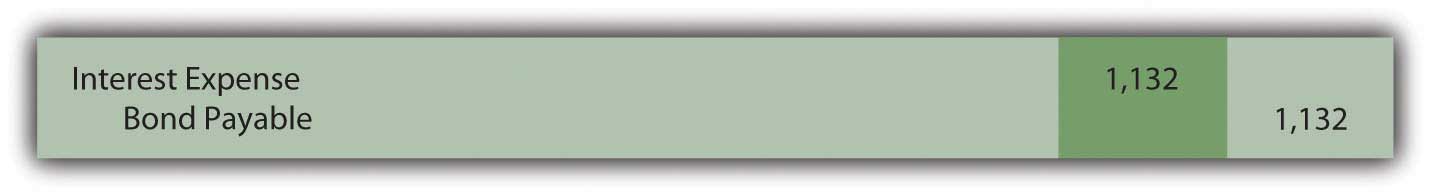

Journal Entry for Zero Coupon Bonds | Accounting Education Journal Entry for Zero Coupon Bonds · 1. Face Value · 2. Present Value or Principle · 3. Discount or Interest · 1. When company gets the present value of zero ... Accounting for Zero-Coupon Bonds - 2012 Book Archive Prepare journal entries for a zero-coupon bond using the effective rate method. Explain the term "compounding." Describe the theoretical problems associated with the straight-line method, and identify the situation in which this method can be applied. The Issuance of a Zero-Coupon Bond Zero Coupon Bond Journal Entry - allcoupons.org Zero Coupon Bond Journal Entry - allcoupons.org. CODES (4 days ago) Journal Entry for Zero Coupon Bonds - Accounting … CODES (3 days ago) Now, we are ready to pass the journal entries of zero coupon bonds. For example, A company issues $ 20,000 zero coupon bond in the market. Mr. David bought it at the discount of $ 3471. Zero Interest Bonds | Formula | Example | Journal Entry Bond is the financial instrument which the issuer sells in the capital market and promise to pay annual interest and face value on the maturity date. For the ...

Accounting Final Exam Flashcards | Quizlet journal entries used to prepare temporary accounts for a new fiscal period. ... zero coupon bonds interest. don't even think about recording a journal entry, sweaty. treasury stock is a. conta-equity account. to calculate new shares issues in stock split. multiply % by outstanding shares. Solved: On January 1, 2021, Darnell Window and Pane issued ... On January 1, 2021, Darnell Window and Pane issued $18 million of 10-year, zero-coupon bonds for $5,795,518. Required: 1. Prepare the journal entry to record the bond issue. 2. Determine the effective rate of interest. 3. Prepare the journal entry to record annual interest expense at December 31, 2021. 4. 14.3 Accounting for Zero-Coupon Bonds - University of ... Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000. Zero Coupon Bond Issued At Discount Amortization ... - YouTube Accounting for a zero coupon bond issued at a discount (issue price less than face value) interest calculation and balance sheet recording, start with a cas...

Bonds Payable in Accounting - Double Entry Bookkeeping Historically, bonds where issued in paper form with a coupon attached to them representing each interest payment. On the due date the bond holder would remove the coupon and exchange it at the bank for the interest payment. As the interest rate was identified on this coupon it became known as the bond coupon rate. A zero coupon bond is a bond ...

Convertible zero-coupon bonds - Ask Me Help Desk Code: PV = $639 million x (1 + 0.5%)^ (-30) = $550 million which is equal to the gross proceeds that were collected, as expected. Focusing on the convertible characteristic, the conversion ratio is 9.4602 as stated. By definition, every Y dollars of Convertible Notes a bondholder receives 9.4602 shares and each share has a conversion price P.

Zero Coupon Bond Journal Entries Pacific Zero Coupon Bond Journal EntriesSales Zero Coupon Bond Journal EntriesCredit Card P.O. Box 790441 St. Louis, MO 63179-0441 Payment Addresses Pacific Zero Coupon Bond Journal EntriesSales Zero Coupon Bond Journal EntriesCredit Card Payments P.O. Box 9001007 Louisville, KY 40290-1007

Deferred Coupon Bond - Accountinguide Company issue 1,000 zero-coupon bonds with a par value of $ 5,000 each. As the bonds do not provide any annual interest to the investors, so they have to be discounted and pay back the full value of par value. The market rate is 5% and the term of the bonds is 4 years. Please calculate the bond price that company needs to sell to attract investors.

Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Coursework Hero - We provide solutions to students Please Use Our Service If You’re: Wishing for a unique insight into a subject matter for your subsequent individual research; Looking to expand your knowledge on a particular subject matter;

Bond Retirement - Lumen Learning Bonds can be classified to coupon bonds and zero coupon bonds. For coupon bonds, the bond issuer is supposed to pay both the par value of the bond and the last coupon payment at maturity. In case of a zero coupon bond, only the amount of par value is paid when the bond is redeemed at maturity. Bonds Payable & The Balance Sheet

Zero coupon bond definition - AccountingTools Zero coupon bond definition January 15, 2022 What is a Zero Coupon Bond? A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds

Leverage (finance) - Wikipedia Accounting leverage is therefore 1 to 1. The notional amount of the swap does count for notional leverage, so notional leverage is 2 to 1. The swap removes most of the economic risk of the treasury bond, so economic leverage is near zero. Abbreviations. EBIT means Earnings before interest and taxes. DOL is Degree of Operating Leverage

14.3 Accounting for Zero-Coupon Bonds Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

Accounting for Issuance of Bonds (Example and Journal Entry) Coupon/Interest = $ 100,000 × 5% = $ 5,000 FV of Coupon/Interest = $ 5,000 × 4.329 = 21,645 Total Value = 78,355 + 21,645 = $ 100,000 The amortization table for the bond and its interest component is given below. ABC Company will record the journal entries for the interest payment yearly.

On January 1, 2021, Darnell Window and Pane issued $18.9 million of 10-year, zero-coupon bonds ...

Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond.

Journal Entries of Zero Coupon Bonds - YouTube Zero coupon bonds are the famous type of bonds in which the company will gives only face value without paying any extra discount. Investor gets earning buy g...

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Accounting Deep Discount Bonds - CAclubindia A. Zero Coupon Bond (Deep Discount Bond) Zero-coupon bond (also called a discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond.

Related Accounting Q&A - bartleby On January 1, 2021, Darnell Window and Pane issued $18 million of 10 year, zero-coupon bonds for $5,795,518.Required:1. Prepare the journal entry to record the bond issue.2. Determine the effective rate of interest.3. Prepare the journal entry to record annual interest expense at December 31, 2021.4.

Post a Comment for "42 zero coupon bond journal entry"